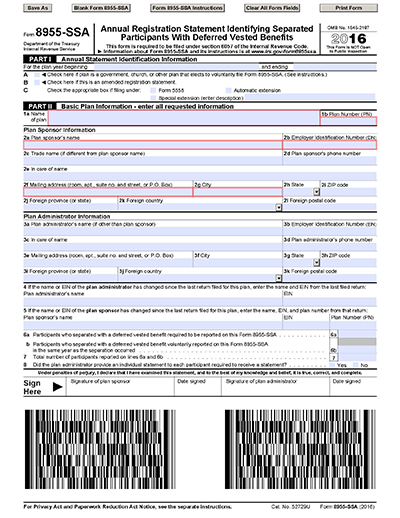

Under Employee Retirement Income Security Act (ERISA), each plan sponsor must notify the IRS of a terminated employee who has a vested benefit in their Plan. If you are subject to ERISA, this is done via Form 8955-SSA (Form 8955). This is the Annual Registration Statement Identifying Separated Participants with Deferred Vested Benefits and is due by the deadline, including extensions, for the 5500 filing of the year in which the participant terminated employment. Although it is not required, some non-ERISA plans may choose to voluntarily file the form to keep former employees informed of their benefits.

Under Employee Retirement Income Security Act (ERISA), each plan sponsor must notify the IRS of a terminated employee who has a vested benefit in their Plan. If you are subject to ERISA, this is done via Form 8955-SSA (Form 8955). This is the Annual Registration Statement Identifying Separated Participants with Deferred Vested Benefits and is due by the deadline, including extensions, for the 5500 filing of the year in which the participant terminated employment. Although it is not required, some non-ERISA plans may choose to voluntarily file the form to keep former employees informed of their benefits.

The Form 8955 is used by the Social Security Administration (SSA) to remind participants of “potential” pension benefits they may be entitled to. However, these SSA statements are notoriously unreliable because plan administrators have always been more diligent about listing participants on the Form 8955 than they are at removing them once the participant's asset are distributed from the Plan. In fact, I have a few clients that have employees who terminated employment over a decade ago and have received a letter from the SSA saying that the employer “MAY” owe the participant a specific dollar amount. And yes, the “MAY” was capitalized in the IRS letter sent to my client’s participant.

The form instructions give plan sponsors the choice to include participants separating in the current reporting year or in the prior reporting year. However, using those separating in the prior year is generally an easier approach because it reduces the urgency to capture current termination data by period-end. Additionally, reporting in the plan year following separation provides participants additional time to plan and take their distributions, thereby reducing the number of reportable separated participants.

Form 8955-SSA allows you to “delete” separated participants who were previously reported if their vested benefits were subsequently distributed in full. Unfortunately, this is often overlooked, resulting in a participant who has already taken their distribution to receive a formal letter from the SSA saying they still have money in the Plan that they are entitled to. And yes, participants will assume that your Plan still has money that is owed to them.

To verify if separated participants were previously reported, you should refer to previously filed Forms 8955 or, for a qualified plan, the Schedule SSA attached to Form 5500 filed for 2008 and earlier years.

It is a best practice to include previously reported separated participants as deletions in the year that full distribution occurs. If terminated participants, who were previously reported, are not subsequently deleted following a full distribution of their vested benefits, the SSA is likely to notify the separated participants or their beneficiaries applying for Social Security benefits that deferred vested benefits may remain in your Plan, and that participant will undoubtedly call you.

If a participant does reach out to you, please understand that is your responsibility to research the Plan’s historical records to validate, or update the information provided by the SSA. The first step we recommend is to reach out to your vendors to get written confirmation of the participants distributions.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice.

Any views expressed herein are those of the author(s) and not necessarily those of Multnomah Group or Multnomah Group’s clients.