Earlier this month, the Securities and Exchange Commission (SEC) launched an investigation into the sales and compensation practices of defined contribution plans offered to teachers and government employees. The information request was sent to companies that administer retirement plans. Based on media reports, the inquiry is seeking to understand how investments are selected for participants and how potential conflicts are being managed by the providers. These plans have long been criticized for including high-cost investments options from which participants may select.

State and local government-sponsored 403(b) and 457 plans are governed by state law rather than federal standards (ERISA – Employee Retirement Income Security Act). In general, state law requires that decisions are made in the best interest of participants, but it is commonly accepted that ERISA requires a higher standard for plan sponsors.

This SEC investigation highlights one of the key benefits for participants saving for retirement in private sector plans – ERISA. As you may have heard us say many times in meetings, ERISA requires that plan sponsors must make decisions that are solely in the best interest of participants and beneficiaries. This high standard requires a prudent decision making process to be followed.

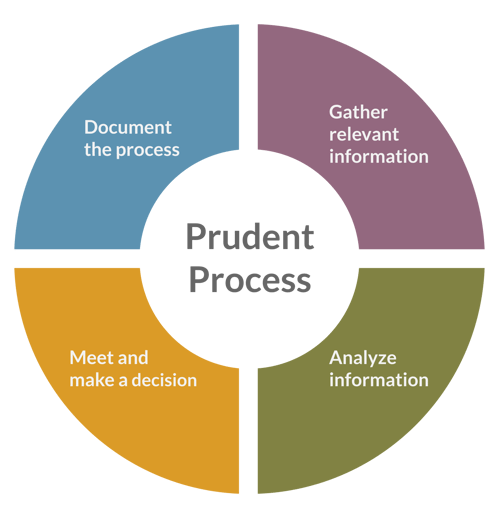

A documented process is central to each decision made by plan sponsors overseeing retirement plans, including items like vendor selection and management, fee oversight, and investment selection and monitoring. We believe that by consistently applying the ‘best interests’ standard, the resulting decision will meet ERISA’s requirements and provide the plan sponsor with good governance oversight.

Additionally, the process wheel above is circular. In order to fulfill the ‘best interests’ requirement, plan sponsors have an ongoing duty to monitor and revisit their decisions as they acquire new information. Many of the issues noted in the public sector plans (e.g. high-cost investments and annuities, proprietary investment offerings, cross-selling financial products, etc.) used to be commonplace in private sector plans. But through persistent monitoring and evaluation, many plan sponsors have modernized their plans features, cost structure and vendor service model.

While there are still areas to improve, evidenced by litigation and regulatory audits, I would argue that participants in ERISA governed plans benefit from the diligence required of plan sponsors. The industry has seen significant declines in fees (investment management and recordkeeping), improved participant services including retirement planning tools, timely contribution funding, and open investment fund menu architecture.