Each time the retirement plan committee meets, does it feel like there is a new rule or legislation your plan is required to comply with? While at the same time, participants are demanding more of you and your organization to be successful because the defined contribution plan is likely the only savings vehicle these individuals will ever have for retirement? If these feelings resonate with you, so will the committee best practices we discuss in this guide. Keep reading as we help you understand what the Employee Retirement Income Security Act (ERISA) (and similar state laws) requires for plans, how committees have typically functioned, and how committees will need to function to be successful and sustaining for years to come.

ERISA’s Influence on Fiduciaries and Committees

ERISA, which governs private employer-sponsored retirement plans, outlines the minimum requirements for plans. Because employers (also known as plan sponsors) are entrusted with the assets of their employees (also known as participants), plans covered by ERISA are all required to have at least one fiduciary named in a written document.[1] Even those plans that ERISA does not govern are governed by the Internal Revenue Code (the Code) and a set of state laws that likely resemble ERISA, meaning these same requirements will generally apply.

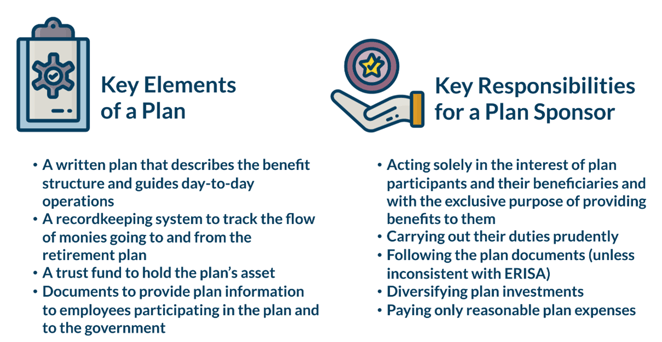

Historically, retirement plans were simple. There were a few basic elements to the plan (as identified by the Department of Labor) and the basic responsibilities outlined in ERISA Section 404[2]:

Over time, retirement plans have grown increasingly more complex. The basic components that existed when ERISA passed in 1974 have rapidly expanded with technology in retirement plans. Investments, service providers, litigation, and legislation are in constant motion. The list of what the DOL considers to be fiduciary obligations is constantly expanding. For example, a decade ago, procedures related to cybersecurity and missing participants were not top of mind for plan sponsors; these are now requirements for retirement plan sponsors. What once could have been handled by one or two people at the organization now typically takes a formalized delegation process reliant on calendars, checklists, and process plans as well as third-party consultants. Thus, most retirement plans go well beyond the requirement of having one fiduciary and instead have several.

A fiduciary, or someone acting on behalf of another, is specifically defined under ERISA to include anyone exercising discretion or authority on behalf of the plan as it relates to the plan’s assets or the management of the plan. One becomes a fiduciary by virtue of their function related to the plan and not via a title at the organization.

Many plan sponsors delegate the oversight and administration of their retirement plan to a committee within their organization. This committee takes on fiduciary responsibility for almost all aspects of managing and overseeing the employer’s retirement program. The committee may further outsource fiduciary obligations by prudently selecting and monitoring service providers.

While not required, the successful delegation of responsibility from the plan sponsor to a committee for ongoing administration of the plan is often handled through a committee charter or other delegation document. The committee charter generally sets forth expectations of how the committee will operate and details items such as frequency of meetings, assignment of roles for certain committee members, expertise expected from committee members, and the reporting requirements. While a charter is not required by ERISA, it is a helpful tool for all members of the organization with responsibility under ERISA, and it can help fiduciaries to understand their status as a fiduciary; likewise, it can assist those non-fiduciary staff members at the organization in understanding how to maintain their ministerial roles, if desired.

Our next blog in this series will focus on the historical models of retirement plan committees and moving forward what committees need to do to create stronger governance programs for better retirement plans.

To read our complete guide on this topic, "Retirement Plan Best Practices: Understanding the Importance of Continuous Growth for your Plan and Participants," click here.

To read our complete guide on this topic, "Retirement Plan Best Practices: Understanding the Importance of Continuous Growth for your Plan and Participants," click here.

Notes:

[1] See ERISA Section 402(a).

[2] See DOL, Meeting Your Fiduciary Responsibilities.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice.