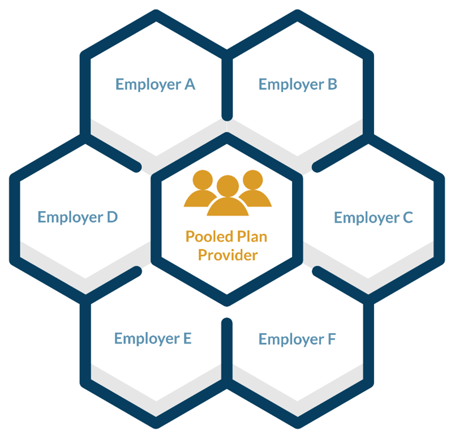

A Pooled Employer Plan (PEP) is a new type of retirement plan that was created by the Setting Every Community Up for Retirement Enhancement Act (SECURE) Act. A PEP allows plan sponsors to pool their retirement resources with the resources of other employers, as well as delegate many plan operations and fiduciary responsibilities to a third party.

A Pooled Employer Plan (PEP) is a new type of retirement plan that was created by the Setting Every Community Up for Retirement Enhancement Act (SECURE) Act. A PEP allows plan sponsors to pool their retirement resources with the resources of other employers, as well as delegate many plan operations and fiduciary responsibilities to a third party.

We have a new FAQ resource that breaks down the PEP information plan sponsors need and want to know. It covers:

- Who can sponsor a PEP?

- What are the advantages of a PEP from a single employer-sponsored 401(k)?

- What are the reporting requirements for a PEP?

- What type of fiduciary liability will an employer that adopts a PEP have?

If you're interested in reading the FAQ or downloading a copy of the PDF, click here.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice. Any views expressed herein are those of the author(s) and not necessarily those of Multnomah Group or Multnomah Group’s clients.