As a firm, we are currently helping clients go through a flurry of 403(b) plan restatements. The restatement period is a good time to review internal administrative processes to make sure they are aligned with the plan document. It is also an ideal time to evaluate potential plan design changes. This can be anything from eligibility, automatic enrollment or automatic escalation, to employer contributions and vesting schedules. One plan design element that does not get a lot of attention but has an impact on plan demographics, administration, and retiree outcomes is allowable distribution options.

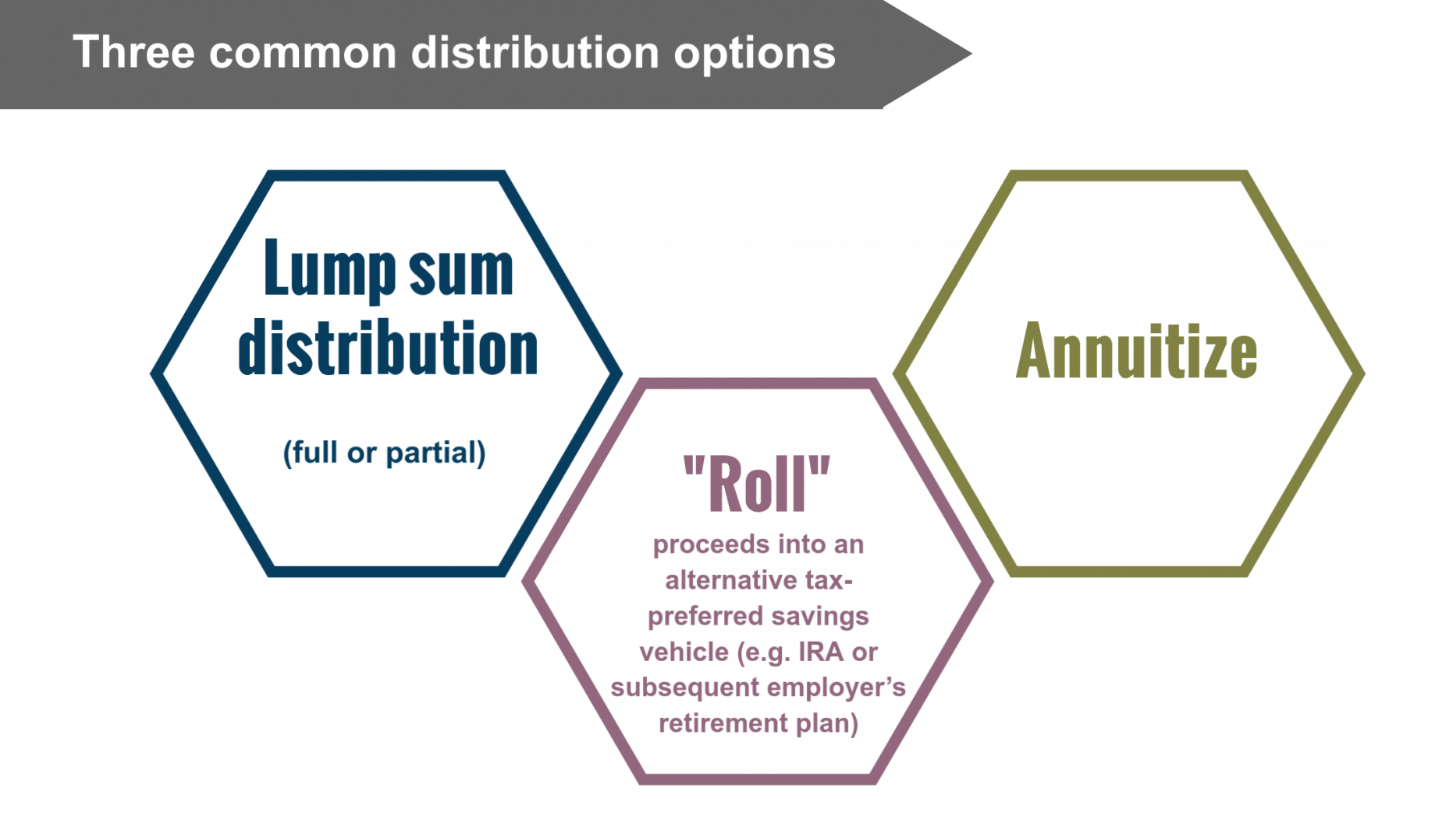

- Lump-sum payment – a distribution of the full amount of a participant’s (or beneficiary’s) vested account balance.

- Partial lump-sum – a distribution of a portion of the vested account balance.

- Installment/Systematic payments – a set even payments made at regular intervals for a period of time or until the account is fully depleted.

- Annuity Payments/Spousal Annuities – a set of even payments made at regular intervals guaranteed by an insurance provider for a set period of time or for the life of a participant. Spousal annuities can also include payments for a surviving spouse of the original beneficiary. Defined benefit plans are required to offer annuity payments as a distribution option.

When deciding which distributions types to allow in a plan it is important to consider the Committee’s goals for the plan. Ask yourself some questions:

- When an employee separates from service, do I want them to leave their money in the plan?

- Does my recordkeeping vendor have processes in place to find lost participants?

- Is maintaining a larger asset base and/or high average account balances important to me?

- Do I have the administrative capabilities to maintain a larger population base?

- Is there a lot of turnover in my organization?

- How paternalistic do I want to be with my participants?

Several of these questions have no right or wrong answer and instead get to the philosophy of the plan sponsor.

Lump Sum Only

Offering only lump-sum distributions is a way to ease administrative burdens. Participants who are no longer at your organization are more difficult to keep track of, but still, require much of the same administrative support as active employees including required annual and ad-hoc disclosure notices. Terminated participants may also be more likely to require hard copies of notices, increasing notice fulfillment costs. As a plan sponsor, it is your responsibility to keep track of your participants. Additionally, plan administrators are legally responsible for ensuring that required minimum distributions are completed and missing those can put a plan’s qualified status in jeopardy. On the bright side, your recordkeeper may be able to assist in some of this administrative burden, and we see more and more recordkeepers have processes in place to search for and find lost participants.

Allowing only lump-sum distributions does not inherently limit participants from setting up systematic withdrawals or purchasing annuities. It only requires that those now former participants handle that outside of the plan.

Expanded Options

Offering additional distribution options, where part or all of the account balance remains in the plan are considered more “retiree-friendly” as well as more paternalistic. Much of the hard work a plan sponsor does as a fiduciary to create the best outcomes for participants can be wiped away by expensive or even predatory service providers at decumulation. Allowing participants to stay in the plan means they continue to benefit from the plan sponsor’s ongoing monitoring of services and fees of the vendors.

There are other potential benefits to the plan sponsor when keeping more participants in the plan. The higher total asset balance may allow for reduced investment management expense because the plan now meets minimum purchase requirements for less expensive share classes. Recordkeeping fees are often calculated based upon average account balances which can be a double-edged sword when allowing participants to remain in the plan. On one side, retaining long tenured participants near retirement likely means retaining a high account balance, which may pull up the average. However, retaining shorter tenured participants with lower account balances may pull down the average. Employee demographics and turnover may enlighten you to which end of the spectrum your plan lies.

Review, Discuss, Decide

There is no single answer to this question for plan sponsors. You must weigh the administrative costs with the goals and philosophy of those overseeing the plan. If you are going through a document restatement or considering other plan design amendments, it is worth taking a look at the distribution options you currently allow and evaluating whether they align with your goals.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice. Any views expressed herein are those of the author(s) and not necessarily those of Multnomah Group or Multnomah Group’s clients.