Many active fundamental growth managers have struggled to outperform their peer groups for the 1-year period ending June 30th. Typically, fundamental-focused investment managers try to generate alpha through their security selection and focus on business quality and earnings growth potential over an intermediate to long-term investment horizon. The last year has been challenging for these managers based on two factors: (1) our current low interest rate environment has many investors searching out dividend-paying stocks for the income opportunity and (2) several acute periods of market stress, including the most recent Brexit related market shock, have driven many investors to perceived “safe havens.”

Many active fundamental growth managers have struggled to outperform their peer groups for the 1-year period ending June 30th. Typically, fundamental-focused investment managers try to generate alpha through their security selection and focus on business quality and earnings growth potential over an intermediate to long-term investment horizon. The last year has been challenging for these managers based on two factors: (1) our current low interest rate environment has many investors searching out dividend-paying stocks for the income opportunity and (2) several acute periods of market stress, including the most recent Brexit related market shock, have driven many investors to perceived “safe havens.”

The best performing sectors for the last year have been defensive: utilities (up 31.47%), telecom services (25.14%), and consumer staples (18.66%). Many fundamental growth managers underweight or equal weight these sectors relative to their benchmarks because they see very modest growth potential.

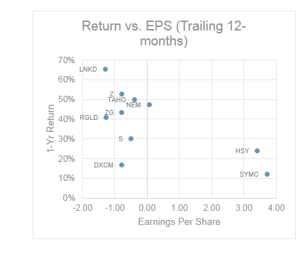

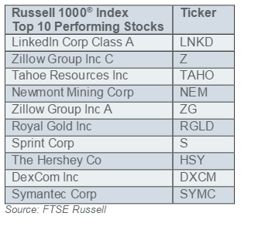

We looked at this quarter’s top 10 performers in the Russell 1000® Index, a common large cap proxy, and compared the stocks’ 1-year performance relative to their earnings growth over the same period1. Of these 10 stocks, 7 had negative earnings growth.

We looked at this quarter’s top 10 performers in the Russell 1000® Index, a common large cap proxy, and compared the stocks’ 1-year performance relative to their earnings growth over the same period1. Of these 10 stocks, 7 had negative earnings growth.

While recent performance for these managers has been disappointing, short-term volatility is not unexpected during periods of market stress. Managers who stay committed to their growth investment mandate can be expected to rebound as the market returns to fundamentals.

1 Performance information provided by Morningstar.