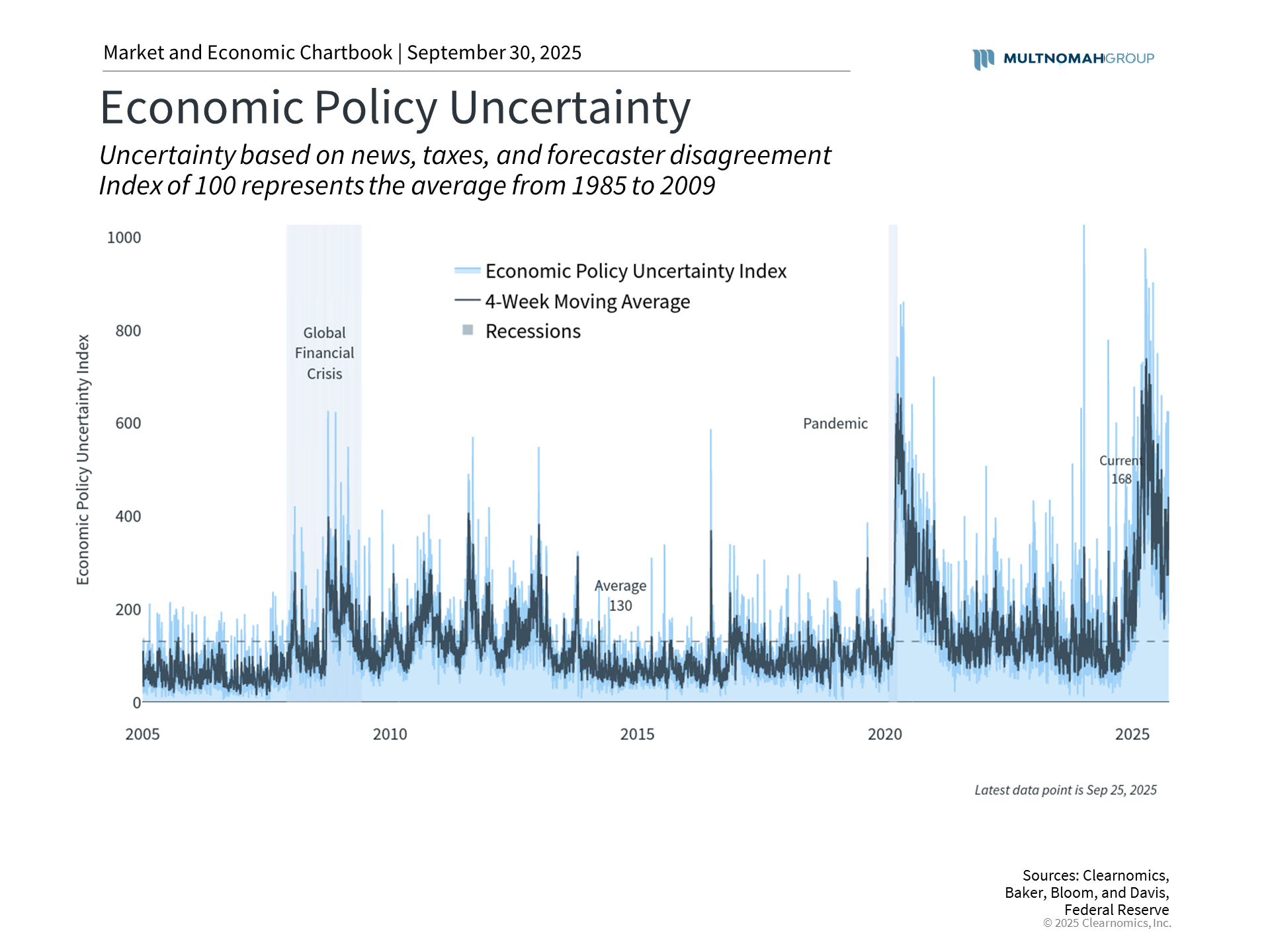

Federal funding negotiations have once again captured Washington's attention as lawmakers work to prevent a government shutdown. This development comes during a year marked by considerable policy uncertainty across multiple fronts, including trade, taxation, and immigration matters.

Investors often question how political developments might influence their investment portfolios, particularly those who monitor fiscal responsibility concerns. Examining past patterns and recognizing why markets typically remain resilient can provide valuable context when political negotiations reach an impasse.

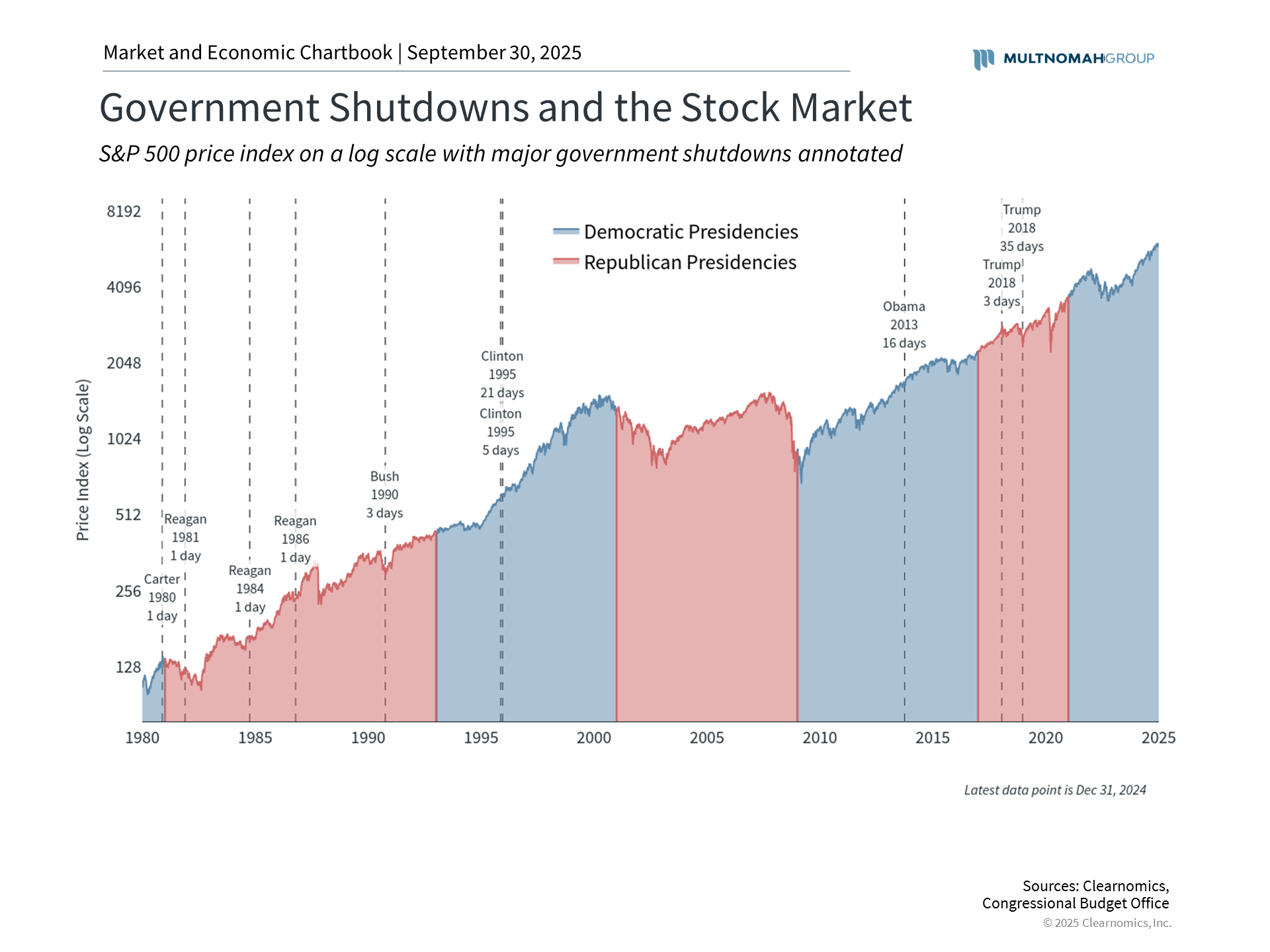

While Washington's political theater can generate uncertainty, historical data reveals that government shutdowns usually produce limited effects on financial markets. Although these events can impose genuine hardship on federal employees, their influence on market performance has been consistently modest. For investors with long-term horizons, these situations underscore the importance of distinguishing between political perspectives and financial strategy. This becomes particularly relevant when news cycles emphasize contentious issues that haven't traditionally influenced investment outcomes.

Historical data shows minimal market impact from government shutdowns

Each year, the federal government must approve a budget for the upcoming fiscal year starting October 1. Though the "One Big Beautiful Bill Act" passed earlier this year establishing tax and spending frameworks, Congress must still allocate specific funding to various departments and agencies. Missing this deadline may trigger a shutdown, causing service interruptions and employee furloughs.

Meeting budget deadlines has proven challenging for Congress. Given Washington's increasingly divided political landscape, where finding common ground has grown more difficult, this pattern is perhaps unsurprising. Across nearly five decades, Congress has successfully passed appropriations legislation before the fiscal year deadline only occasionally, making eleventh-hour negotiations standard practice. A common workaround involves "continuing resolutions" that provide temporary funding during negotiations.

The accompanying chart demonstrates that government shutdowns have been recurring events since 1980 across different administrations, with limited lasting effects on markets. Notable examples include shutdowns during Reagan's presidency, Clinton's 21-day closure in 1995, Obama's 16-day shutdown in 2013, and Trump's record-setting 35-day shutdown spanning late 2018 to early 2019. From an investment perspective, these episodes have typically represented brief interruptions rather than significant threats to economic expansion.

Budget impasses reveal fundamental policy disagreements

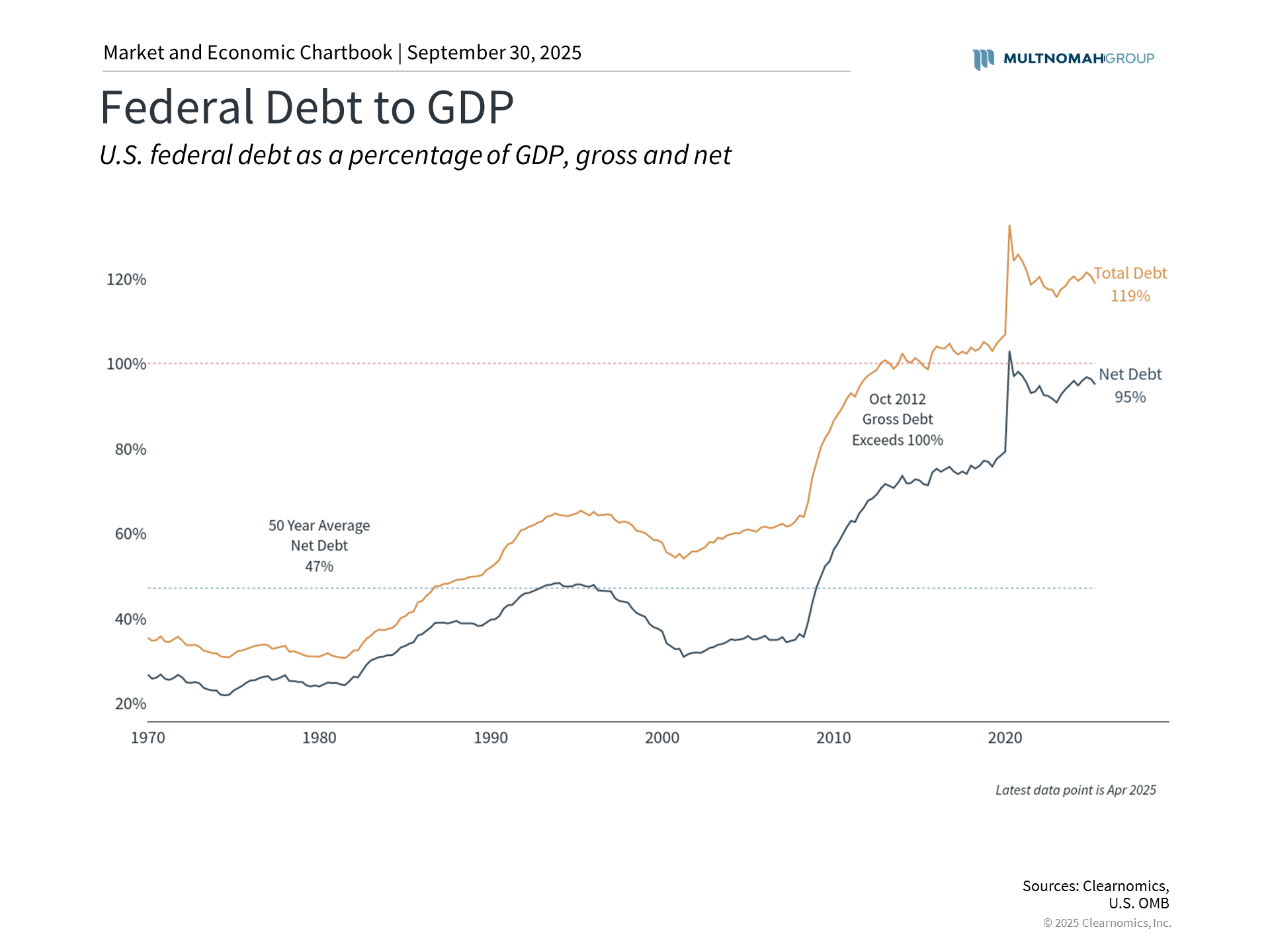

Present circumstances stem from disputes over spending allocations, particularly regarding healthcare programs. Although immediate government funding remains the central issue, these budget conflicts highlight broader philosophical differences about government's proper scope and fiscal accountability. With federal debt reaching approximately 120% of GDP, consensus exists around the necessity of fiscal restraint, yet disagreement persists regarding implementation methods.

This situation stands apart due to the administration's instruction for agencies to develop permanent workforce reduction strategies beyond standard temporary furloughs. This approach differs from historical shutdown patterns and may produce more enduring effects on employment and government expenditures. Note that furloughed federal employees automatically receive retroactive compensation after shutdowns conclude, a policy established during negotiations ending the 2018 to 2019 shutdown.

Some investors may conflate shutdown concerns with other fiscal matters like the debt ceiling. Debt ceiling issues emerge when previously authorized spending requires payment, but the Treasury Department lacks authority to borrow beyond established limits. Congress must then raise the borrowing limit to prevent default on government obligations. These fiscal challenges contributed to major credit rating agencies downgrading U.S. debt from AAA status. The One Big Beautiful Bill Act increased the debt ceiling by $5 trillion, postponing this concern.

Financial markets prioritize economic fundamentals over political news

Despite investor concerns about the nation's fiscal path, government shutdowns have typically proven inconsequential for financial markets. The explanation is clear: shutdowns represent temporary interruptions that don't alter core economic conditions.

Economic data releases may experience disruptions during shutdowns, potentially affecting key indicators like the Bureau of Labor Statistics' employment reports and Consumer Price Index. However, this usually only postpones data availability, with normal reporting resuming after resolution. Extended shutdowns can create modest economic drags as federal workers curtail spending and government operations face interruption.

The Economic Policy Uncertainty chart above illustrates how tariffs and tax policy earlier this year posed substantial challenges for investors. Nevertheless, following recent resolution of both matters, this metric has declined toward its historical average. While shutdowns could potentially increase uncertainty, historical evidence indicates that even prolonged government disruptions haven't typically affected investors.

The bottom line? Although government shutdowns may capture headlines, affect federal workers, and interrupt essential services, they have historically produced minimal effects on financial markets. Investors should maintain their focus on long-term financial objectives rather than daily political developments.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group's website is provided for education purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.