Recent years have delivered impressive stock market gains that have benefited investors and strengthened financial plans. However, this period of strong performance can create unrealistic expectations about future returns and long-term financial outcomes. Successful investing requires navigating both favorable and challenging market environments, making it essential to establish expectations rooted in historical data, rigorous analysis, and personalized financial strategies.

Behavioral finance examines how human psychology influences investment decisions. More than five decades of research demonstrates that investors frequently fall prey to cognitive and emotional biases that can undermine their financial success. While market movements, economic conditions, and policy decisions remain outside our control, we can manage our responses to these external factors.

Recognizing these behavioral tendencies serves a practical purpose beyond academic interest. These biases affect all investors regardless of education or intelligence. What distinguishes successful long-term investors is not avoiding biases altogether, but implementing disciplined approaches and frameworks that guide sound decision-making despite these natural tendencies.

Look beyond recent performance to understand long-term patterns

Investors commonly place excessive emphasis on recent market events, a phenomenon behavioral scientists call recency bias. This becomes problematic when short-term observations overshadow well-established historical patterns. The notion that "this time is different" often emerges from limited data points rather than comprehensive analysis.

Following six years of double-digit gains within a seven-year span for the S&P 500, investors may mistakenly view such performance as typical rather than extraordinary. This perception creates two potential pitfalls: assuming the trend will persist indefinitely or believing a downturn must be imminent simply because markets have risen substantially.

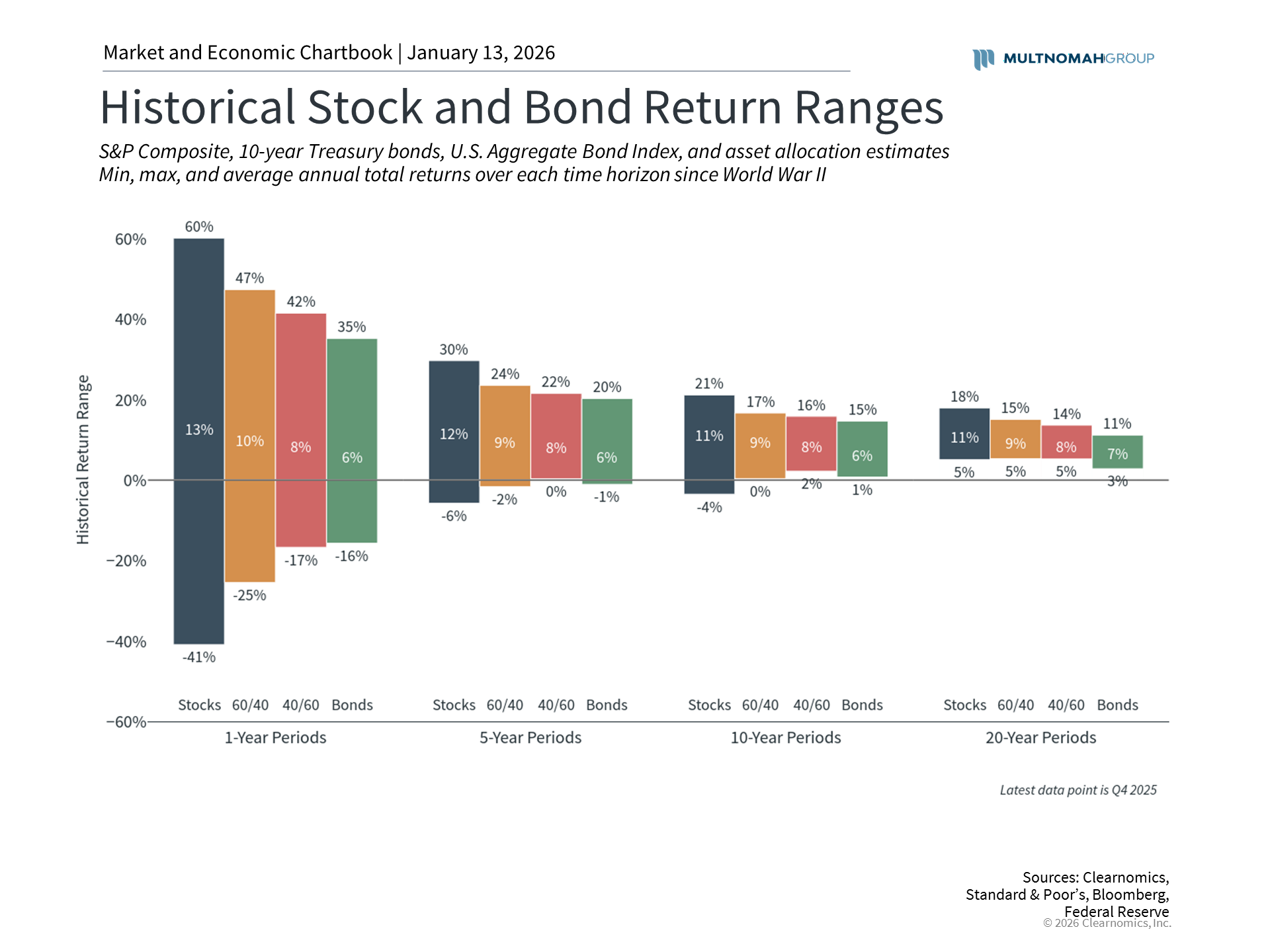

Historical evidence reveals a more complex reality. The chart demonstrates that while the S&P 500 has delivered average annual total returns exceeding 10% over extended periods, yearly performance varies considerably. Previous periods have witnessed similar stretches of strong returns, yet these episodes offer no guarantees about future outcomes. Successful long-term investing focuses on capturing the market's overall upward trajectory rather than predicting near-term results based solely on recent experience.

Recency bias becomes particularly problematic when combined with herd mentality. During rising markets, fear of missing out can prompt investors to deviate from sound financial plans. They might increase equity exposure beyond prudent levels, concentrate holdings in popular sectors such as technology and artificial intelligence, or assume inappropriate risk levels. Historical patterns show that investor sentiment fluctuates, making it crucial to avoid getting swept up in any particular trend.

Addressing these biases doesn't mean dismissing recent performance, but rather placing it within appropriate historical perspective. Strong returns warrant portfolio reviews to confirm that asset allocations remain consistent with long-term objectives.

Approach portfolio changes with objectivity rather than emotion

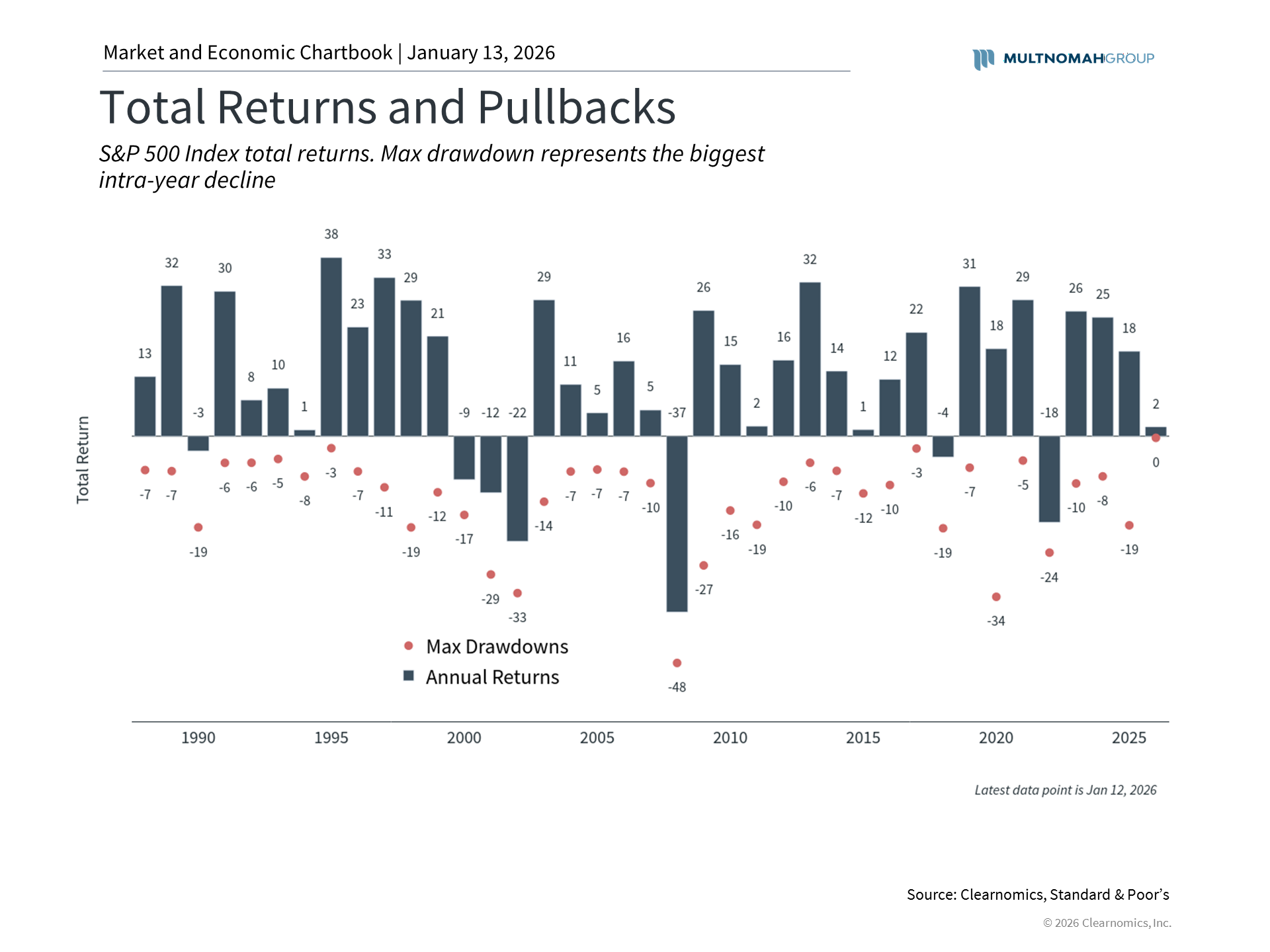

Another relevant bias involves how investors perceive gains and losses in their portfolios. Stock market history illustrates this clearly. When examining the S&P 500 across multiple decades, periodic downturns appear relatively modest compared to the market's long-term upward path. During these declines, however, investors often experience powerful emotional reactions.

Psychologists Daniel Kahneman and Amos Tversky, whose work established the foundation of behavioral science, observed that "losses loom larger than gains." This describes loss aversion, where individuals experience the pain of losses more acutely than the pleasure of equivalent gains. Consider receiving $100 and the satisfaction it brings, then compare that to losing $100 and its lingering impact. For most people, the negative feelings from loss prove more memorable and influential in shaping future choices.

This matters because reaching financial objectives demands maintaining discipline and staying invested during both rising and falling markets. The chart shows that despite the stock market advancing in roughly two-thirds of years, significant intra-year declines occur regularly. Recent tariff-related volatility exemplifies this pattern. Investors who exited positions prematurely, particularly near market lows, forfeited the subsequent recovery that propelled markets to record levels.

Explore opportunities beyond familiar markets and sectors

Home bias, the tendency to favor familiar investments based on geographic proximity, has become increasingly relevant in current markets. One manifestation, home country bias, leads investors to overweight domestic holdings even when international opportunities appear compelling.

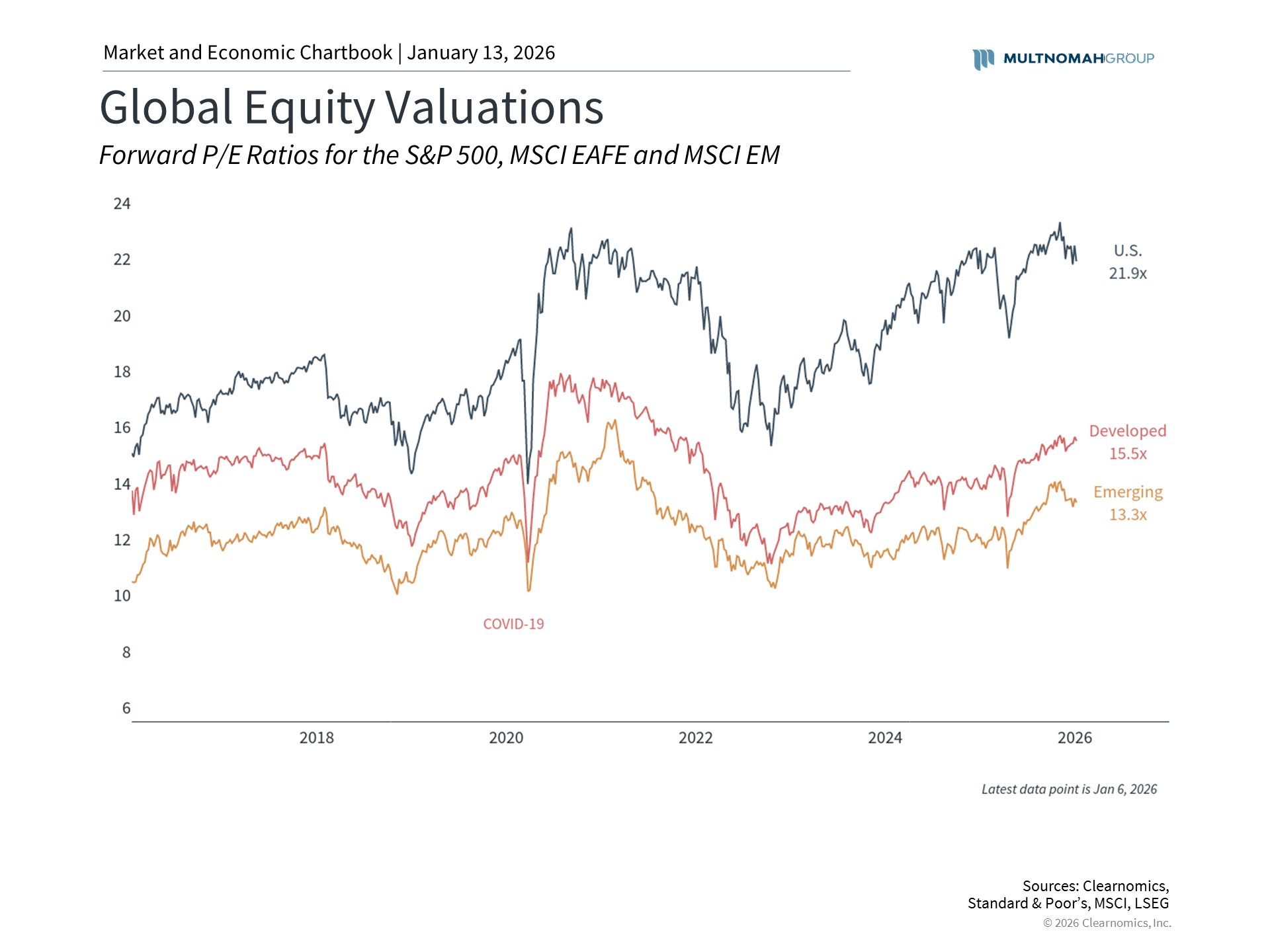

During the past decade, U.S. equities generated superior returns compared to developed and emerging markets, supported by technology sector strength and robust corporate earnings. This pattern doesn't persist indefinitely. In 2025, both the MSCI EAFE index of developed market stocks and the MSCI EM index of emerging market stocks surpassed U.S. market performance in dollar terms. While continuation of this trend remains uncertain, it underscores the value of diversification across asset classes and geographic regions.

Historical evidence confirms that market leadership rotates unpredictably over time. The chart reveals that international markets currently trade at more attractive valuations than U.S. equities, potentially enhancing portfolio risk-reward profiles. Ultimately, successful investing prioritizes consistent outcomes across complete market cycles rather than maximizing returns during any isolated period.

The bottom line? Following multiple years of robust market gains, investors must maintain realistic expectations about future returns. Historical evidence demonstrates that equity markets support long-term wealth accumulation, but achieving this outcome requires managing emotional reactions to near-term market fluctuations.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group's website is provided for education purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice.

Copyright (c) 2026 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.