Here at Multnomah Group, we try to keep the financial jargon to a minimum. But even where we may succeed, you’re likely to encounter references elsewhere that can turn valuable information into mumbo-jumbo yet to be translated.

Consider us your interpreter. Today, we’ll explore correlation, and why it matters to investing.

A Quick Take: Correlation Helps People Invest More Efficiently

Expressed as a number between –1.0 and +1.0, correlation quantifies whether, and by how much two holdings have behaved differently or alike in various markets. If we can identify holdings with weak or no expected correlation among one another, we can combine these diverse “pieces” (individual investments) into a greater “whole” (an investment portfolio), to help investors better weather the market’s many moods.

Correlation, Defined

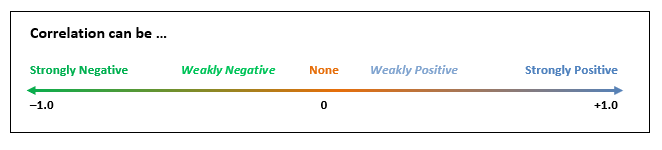

As suggested above, correlation is more than just a quality; it’s also a quantity – a measurement – offering two important insights along a spectrum of possibilities between –1.0 and +1.0:

- Correlation can be positive or negative, which tells us whether two correlated subjects are behaving similar to or opposite of one another.

- Correlation can be strong or weak (or high/low), which tells us how powerful the similar or opposite behavior has been.

Correlation, Applied

If you’ve been around the investment block, you’ve probably heard about the benefits of diversification, or owning many, as well as many different kinds of holdings. A well-diversified portfolio helps you invest more efficiently and effectively over time. Diversification also offers a smoother ride, which helps you better stay on course toward your personal financial goals.

But in a world of nearly infinite possibilities, how do we:

- Compare existing funds – If one fund is expected to perform a certain way according to its averages, and another fund is supposed to perform differently according to its own averages, how do you know if they’re really performing differently as expected?

- Compare new factors – What about when a researcher claims they’ve found a new factor, or source of expected returns? As this University of Chicago paper explains, “factors are being discovered almost as quickly as they can be packaged and sold to the waiting public.” How do we determine which are actually worth considering out of the hundreds proposed?

- Compare one portfolio to another – Even perfectly good factors don’t always fit well together. You want factors that are not only strong on their own, but that are expected to create the strongest possible total portfolio once they’re combined.

Correlation is the answer to these and other portfolio analysis challenges. By quantifying and comparing the behaviors and relationships found among various funds, factors and portfolios, we can better determine which combinations are expected to produce optimal outcomes over time.

Correlation, Calculated

Fortunately, as an investor, you don’t necessarily need to know how to precisely calculate correlations. But it’s useful to know what correlation measurements mean when you see them.

- Strong (high), positive correlation tells us that two investments seem to be playing a highly similar role; when that’s the case, you may not need to hold both of them.

- Strong (high), negative correlation offers the most diversification, but it’s hard to find. Prone as they are to herd mentality, most holdings follow general trends at least a little.

- Weak (low) or no (zero) correlation is thus the preferred relationship we typically seek between and among the funds we use to build a diversified portfolio.

Here’s a simplified example of appealing correlation among three holdings. Each holding exhibits a satisfying level of weak or no correlation with the other two. (A holding will always have perfect positive correlation with itself, thus the +1.0 measurements.)

Appealing Correlation

|

|

Holding 1 |

Holding 2 |

Holding 3 |

|

Holding 1 |

+1.0 |

+0.3 |

–0.2 |

|

Holding 2 |

+0.3 |

+1.0 |

0.0 |

|

Holding 3 |

–0.2 |

0.0 |

+1.0 |

What if your correlations look more like the trio below? Because all correlations here are strongly positive, you might reconsider whether these holdings are sufficiently diversified to make the most of varied market conditions and sources of expected returns.

Too Much Correlation

|

|

Holding 1 |

Holding 2 |

Holding 3 |

|

Holding 1 |

+1.0 |

+0.8 |

+0.9 |

|

Holding 2 |

+0.8 |

+1.0 |

+0.7 |

|

Holding 3 |

+0.9 |

+0.7 |

+1.0 |

Correlation, Concluded

Heeding correlation data is a lot like having a full line-up on your favorite sports team. If each player on the roster adds a distinct, useful and well-played talent to the mix, odds are, your team will go far. Similarly, your investment portfolio is best built from a global “team” of distinct factors, or sources of returns. A winning approach combines quality components that exhibit weak or no correlation among or between them across varied, long-term market conditions.