The private pension system has been tremendously successful in providing U.S. employees the ability to save on a tax-preferred basis and to accumulate adequate reserves to augment the Social Security system. For those who have worked continuously for strong organizations and who have demonstrated strong savings behaviors, it has even developed wealth.

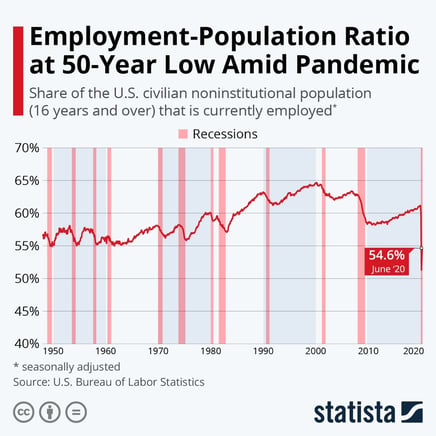

However, the pandemic has exposed several structural economic failings; as it pertains to the private pension system, the issue that arises once again is coverage. The job losses created by COVID-19 have raised the unemployment level to 11.1%. Although that number is alarming, the Employment-Population Ratio, the share of the population over age 16 that is currently employed, is at a 50-year low. The current levels are akin to those a generation ago when middle-class families could prosper on a single income.

Unfortunately, not all 54.6% of the population currently employed are employed by organizations providing access to retirement benefits. The pandemic has exposed the limits of the “gig economy,” as many of those employed are without traditional employee benefits.

Unfortunately, not all 54.6% of the population currently employed are employed by organizations providing access to retirement benefits. The pandemic has exposed the limits of the “gig economy,” as many of those employed are without traditional employee benefits.

Many states have sought to address the coverage gap with default savings programs for small employers, but there continues to be push back from the federal government.

Recently, there has been a push to have the private sector solve the coverage gap with a push for multiple employer plans (MEPs) and pooled employer plans (PEPs). Regrettably, at least in their infancy, these coverage issues cannot be solved by the financial services industry.

To do so requires organizations to assess aggressive fees that ultimately reduce the benefit to the end user.

The states need to continue pushing for retirement plan coverage to be addressed. If not, the private system risks further scrutiny as more tax incentives are allocated to the minority who have access to retirement plan coverage.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice.