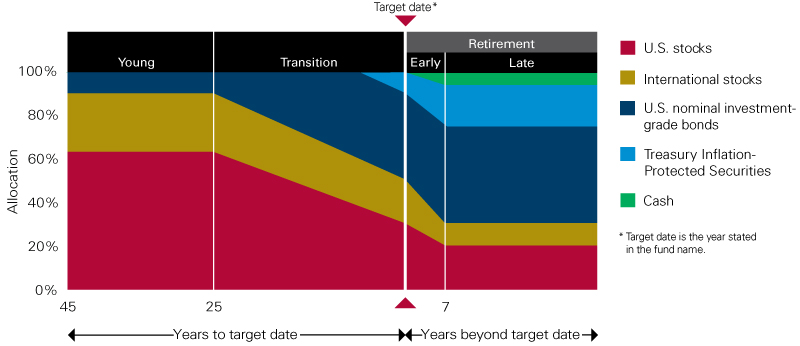

A target date glidepath reflects how a fund’s mix of investments changes over time. When participants are further away from retirement, the asset mix is more growth-oriented, holding a higher percentage of equities. As participants near their retirement date, the fund “glides” down to a more conservative mix of investments, including a higher percentage of fixed income. While it is nearly impossible for a plan sponsor to identify a glidepath that works for every participant, plan sponsors work hard to choose the most suitable glidepath based on the plan’s goals and participant demographics. Glidepath construction is a critical component necessary to form the foundation for a successful target date fund. Target date providers typically utilize some form of outcomes-based analysis to construct their glidepath. The providers use simulation analyses under a variety of market conditions to ensure the glidepath is behaving in line with expectations and will provide the best theoretical chance of achieving a successful outcome.

*Example target date fund glidepath. Source: Vanguard

Why Are Glidepaths Different?

Fund families often have different approaches to glidepaths. Morningstar points out that the target date fund universe shows broad differences in equity allocations at all points along the glidepath. These differences reflect a wide array of target date managers’ approaches and philosophies to construct the ideal glidepath.

Glidepaths differ in multiple areas, including:

- initial equity allocation

- equity allocation at retirement

- terminal equity allocation, and

- “to” versus “through” retirement

The initial equity allocation varies between fund families. This allocation partly speaks to the manager’s concerns surrounding the longevity risk since a higher equity allocation early in the glidepath combats longevity risk. In this case, longevity risk is viewed as the chances that a participant outlives their accumulated retirement savings. Fund families also have differing views of equity allocation at retirement. This varies based on the type of glidepath (“to” vs. “through”). Terminal equity allocation at the end of the glidepath depends on each manager’s research as they seek to balance market, longevity, and inflation risks. The terminal date varies between fund families with some ending their glidepath upon retirement (“to” retirement) while others extending the terminal date by as much as 30 years (“through” retirement).

Based on intensive research subjected to modeling, fund managers choose between “to” and ‘through” retirement glidepaths. “To” glidepaths reach their lowest exposure to stocks at the target retirement date; after that point, they maintain a static asset allocation throughout retirement. “To” funds typically reduce equity allocation aggressively as the retirement date nears, tending to be more conservative before retirement compared to “through” glidepaths. This creates a steeper slope versus its “through” peers. The “steepness” typically occurs from age 40 through 65, when most participants are anticipated to retire.

“Through” retirement glidepaths continue to reduce stock exposure after the target date and into retirement. This glidepath is focused on achieving the highest possible pre-retirement balance. They tend to have higher equity exposure during the early years, at the target date, and for several years into retirement. “Through” glidepaths are usually gradually sloped, continuing to decline until sometime in post-retirement. Over the last few years, several recordkeepers have begun to see participants electing to remain invested in their DC plans well into retirement, furthering the argument for “through” glidepaths. These recordkeepers have adjusted their glidepaths accordingly. However, this is not the case for all recordkeepers.

Capital Markets Assumptions

All target date managers generate their own capital markets assumptions across the relevant asset classes. The expected returns are an integral piece of the asset allocation process and are used in each manager’s investor optimization models. Capital market assumptions are based on long-term expected returns which vary among managers. The returns are reviewed regularly but do not change often, given their long-term nature.

Participant Behavior – Accumulation Assumptions

Accumulation assumptions cover young savers and midlife savers. Young savers are just beginning their careers and can take on greater investment risk. Midlife savers (40 years old until retirement) can take on investment risk, but to a lower degree as young savers as they get closer to their retirement target date. Many target date providers use a human capital / financial capital model in the accumulation phase. Human capital is the net present value of all expected future earnings – it is highest for participants when they are young since they have many years left in their careers to generate earnings. Human capital declines as a percentage of total wealth as the individual ages and as financial capital increases. Financial capital reflects an individual’s total saved assets in stocks, bonds, and other investments. It has an inverse relationship to human capital – starting low and growing over time. Many fund managers will use this framework to inform the glidepath design (allowing for high equity allocations for younger participants with greater expected volatility that gradually decline over time due to lessened earning power from their human capital).

Participant Behavior – Decumulation Assumptions

Americans are living longer and need to plan accordingly to avoid shortfall risk as they convert assets into income. The goal is to generate enough income to sustain withdrawals of a fixed percentage over the course of a participant’s retirement period without depleting funds.

As a participant retires, they face multiple options for how to convert their accumulated savings into retirement income. Some target date fund managers have studied participant behavior as an input to inform their glidepath construction. Some managers who use a “to” glidepath model have argued that the majority of participants withdraw their account balances at retirement and move them to another vehicle (e.g. annuity, IRA, etc.). As such, these managers support a “to” model due to participants seeking alternative means of investment management in their retirement years.

Savings Rate

Contribution rates typically reflect where participants are with respect to their investment journey. Young investors typically have lower contribution rates while older investors have higher contribution rates. The assumed savings rates used typically include employee and employer contributions and will vary between fund managers. Participants risk not accumulating enough assets to fund retirement if their savings rate are too low.

Investment Management

There are many options in the target date fund universe including active, passive, and hybrid series. Active series seek to outperform a benchmark, adding value through manager skill in the timing or selection of securities. Passive series seek to provide market rate of returns, tracking benchmark indices by replicating or sampling the index. Passive series are less expensive than active series. Hybrid series utilize a combination of active and indexed strategies. Plan sponsors can also consider if custom or non-proprietary target date fund would be a better fit. There is no one-size-fits-all target date product. Plan sponsors need to research different options within the space analyzing firm capabilities, investment personnel, investment philosophy, and process.

Slope of the Glidepath

Glidepath slope varies among target date providers and could make a difference in how susceptible participants are to market risk. The slope describes a glidepath’s shape – how quickly or slowly the percentage of stocks in the fund changes as the fund de-risks over time. The pace of de-risking is a hot topic debated regularly by industry experts. A steeper slope indicates a larger difference between the amount of stock a fund has at the beginning compared to the end. Too much slope risk could increase a participant’s exposure to equity market risk, reducing retirement wealth over time or indicate that a narrow amount of time is used to de-risk the average participant. A flatter slope may help reduce overall volatility and loss but may impact a fund’s longevity risk, assuming the fund has maintained below-average equity allocations over the glidepath.

To download a copy of our target date glidepath ranges guide, click here.

For an in-depth review of target date funds, check out our toolkit!

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice.