At Multnomah Group, we celebrate Spring by getting into the weeds on recordkeeping fees. During most of our meetings this quarter, we’ll present our annual recordkeeping fee benchmarking reports. This is a great time to look at whether the fees are reasonable in light of services rendered and can also be a good opportunity to review how those fees are allocated.

In part one of this two part series on fee allocation, we looked at some basic fee models in an attempt to find a good balance of fair and equal. Now we’re going to take a look at some more complex allocation strategies. As we increase complexity, we may increase the sense of fairness between participants, but may lose transparency and increase the administrative burden. Recordkeepers continue to improve capabilities when it comes to fee allocation, however, this is a slow process and the options below may not be possible to implement for every plan.

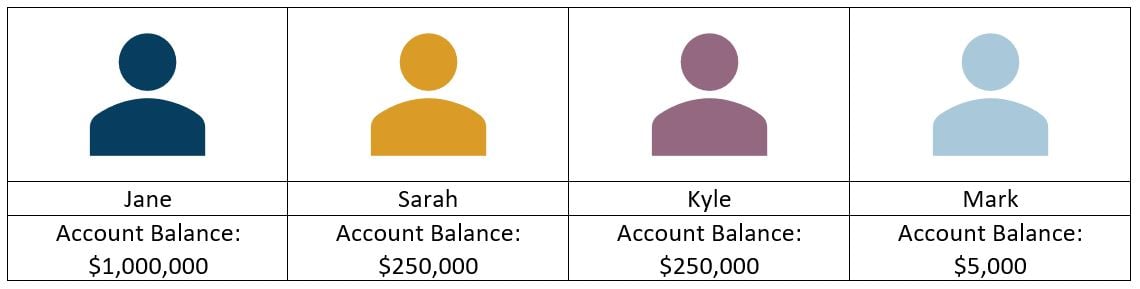

With those caveats in place, let’s look back at our four plan participants.

As we discussed earlier, a flat dollar amount to each participant makes a lot of intuitive sense because it is how most goods and services are charged, and it doesn’t inherently cost more to recordkeep a large account versus a small amount. However, as we saw, those participants on opposite ends of the account balance spectrum, Jane and Mark, end up with fees that felt unequal given their situations. In our scenario in which everyone paid $100, Mark was paying a full 2% of his account balance, a huge drag on his earnings potential.

There are several options to ease this issue.

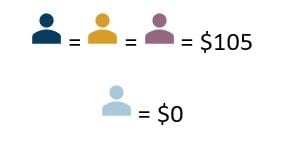

A fee “holiday” for participants under a certain account balance. Let’s combine our $100 per participant example and add in a fee holiday for those participants under $5,000. This benefits newly eligible participants who have just begun their retirement savings. However, to make up for the reduction in fees for some we’ll need to increase the fee for the other participants.

This reallocation of fees could vary substantially based upon the plan demographics. If there is a lot of turnover in the plan and a lot of low balance holders the fees may become more divergent.

This also creates issues with participants as they cross over the threshold where now, a participant who is just barely over that line is now paying a fee and it is higher than what they would have been paying if everyone was charged the same amount.

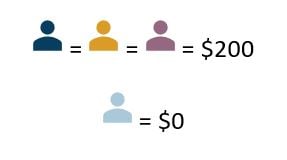

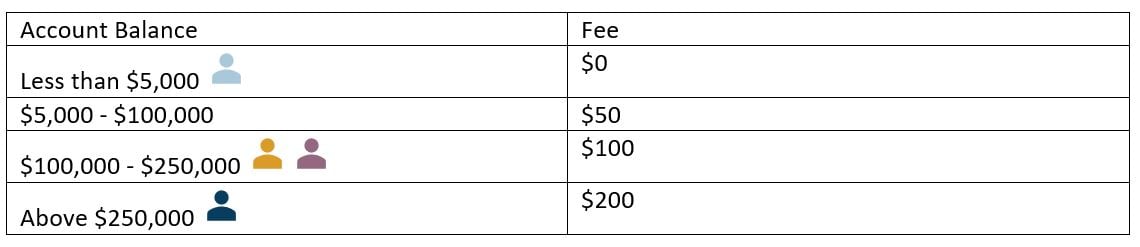

Tiered fees where fees are different for different bands of account balances may help more slowly transition participants from low to high account balances. Continuing our example, let’s add a few more tiers.

The size of the bands and the fee at each tier would need to be carefully calculated when implementing such a model. Additionally, as plan demographics or plan pricing change, these may need to be updated. It is also possible to use different tiers for participants who are no longer employed by the plan sponsor.

There are several other ways to mix and match how the fee is allocated, including caps on total dollar amounts or the asset based fee, a portion paid the participant and another by the plan sponsor, combining a flat dollar with an asset based charged. The sky is the limit. However, the further the envelope is pushed on these allocation models, the more difficult they become to administer and the more often they’ll need to be monitored and tweaked to ensure they stay current with the plan demographics and recordkeeping pricing. As markets move up and down and affect total plan assets and average account balances, an allocation model that was performing well may break.

Any discussion of fee allocation must include a review with the recordkeeper to understand their capabilities. Your Multnomah Group consultant is able to help facilitate that discussion.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice. Any views expressed herein are those of the author(s) and not necessarily those of Multnomah Group or Multnomah Group’s clients.