Spring is in the air, and for those of us here at Multnomah Group, that means we are in the middle of our annual recordkeeping fee benchmarking process. We talk about fees a lot around here, from our guide to plan fees and expenses, to our look at recordkeeper revenue channels. Our recordkeeping fee benchmarking reports are an opportunity to monitor fees and establish if those fees are reasonable in light of services rendered. It is also a great time to dig into how those fees are allocated. There are a wide variety of ways the fee for recordkeeping can be paid, and the landscape continues to change as recordkeeping systems modernize. This is part one of a two-part series looking at the various potential methods for fee allocation.

A common question we are asked as we begin these conversations is, “what is the fairest way to allocate fees amongst participants?” Unfortunately, there is no one answer to this question.

Phrased slightly differently, “what is the most equal way to allocate fees among participants?” The answer to that is easier, there are a multitude of ways for participants to pay equal fees, but where in the world does fair meet equal?

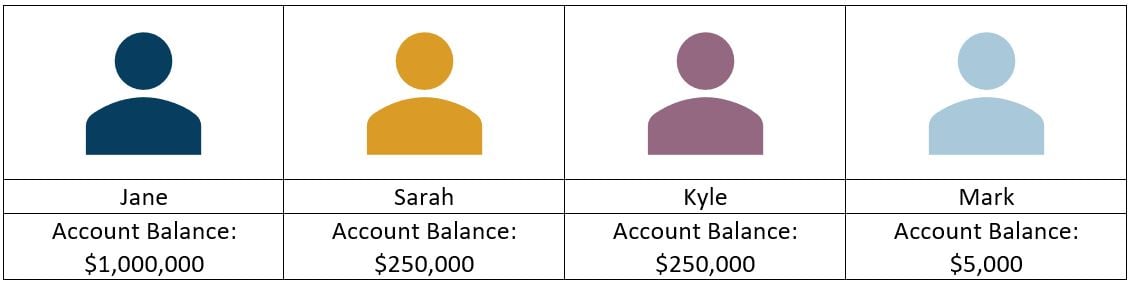

Let’s look at a few different fee models, but first, let me introduce you to some plan participants:

Scenario #1: The plan sponsor pays all recordkeeping expenses.

Everyone is equal. Unfortunately, this scenario is not feasible for many plan sponsors, and may not be the best use of those limited benefit dollars.

Scenario #2: Each participant pays a flat dollar amount, say, $100 for our four participants.

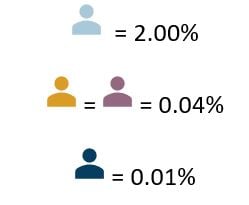

This scenario makes a lot of sense and is how a lot of goods and services are charged, it doesn’t inherently cost more to recordkeep a large account versus a small amount. However, as a percentage of the assets, this is clearly unequal, $100 out of a $5,000 is obviously different than $100 out of $1,000,000. As a percentage of assets our participants actually line up like this:

We can see, the lowest balance participant, Mark, is paying the biggest portion of his balance for recordkeeping. Let’s try the opposite now.

Scenario #3: Each participant pays an even asset-based fee, say, 0.25% on their account balances. Now we know that our higher balance participants will pay more than our lower balance participants.

Again, equal across all participants. However, as a dollar amount we are unequal again.

Here again we see a wide range of fees between our different participants. In both cases, arguably equal, but is one more fair than the other?

Scenario #4: The recordkeeper retains all of the revenue sharing[1] generated by the products in the investment menu. Historically, this is how many plans have paid for recordkeeping and is considered the least transparent of the listed scenarios. Participants do not see a recordkeeping fee listed on their statements, rather, the revenue sharing is part of the expense ratio and is netted out of the investment product’s performance. This can leave our participants all over the place:

The recordkeeping fees our participants pay are based solely on the investment portfolios they select. Some products may generate a high volume of revenue sharing dollars, in the case of Kyle, or no revenue sharing dollars at all in the case of Jane. While this is clearly inequitable, is it unfair? Perhaps Jane is purposefully choosing a portfolio with the lowest expense.

At the end of the day, how fees are allocated depends on the capabilities of the recordkeeper and the philosophy of the individuals overseeing the retirement plan. Capabilities are always changing, so it is a good idea to check in periodically to see if the current fee model is the best fit for plan participants. If none of the above methods hit the spot, keep an eye out for part two of this series where I discuss some more exotic models.

Notes:

[1] A detailed explanation of revenue sharing can be found in the fee guide linked above, but in summary: revenue sharing is a portion of the investments listed expense ratio that the investment manager gives to the recordkeeper as negotiated between the two parties.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice. Any views expressed herein are those of the author(s) and not necessarily those of Multnomah Group or Multnomah Group’s clients.