As we work with clients on their retirement plan investment menus, I have increasingly been looking back on our work from 2008 – 2009. The COVID-19 pandemic has caused tremendous market volatility, and in response to that volatility, the Fed has reduced rates, and money has flooded into government debt.

The result of this movement is a high-speed version of the 2008 crisis with government debt at tremendously low rates.

After two calendar years of money market returns exceeding 2%, government money fund rates are poised to crash again with fund managers initiating fee waivers to avoid seeing their funds “break the buck.”

Looking back to 2008 – 2009, the Quantitative Easing programs from the Federal Reserve Bank served to fuel the subsequent recovery but kept government debt at tremendously low yields. The resulting impact was money market returns of less than 1% in every calendar year from 2009 to 2017. It is impossible to determine how long the current low rates will need to remain in place, but history shows us that while easing can happen quickly, returning to a “normal” rate level may take some time.

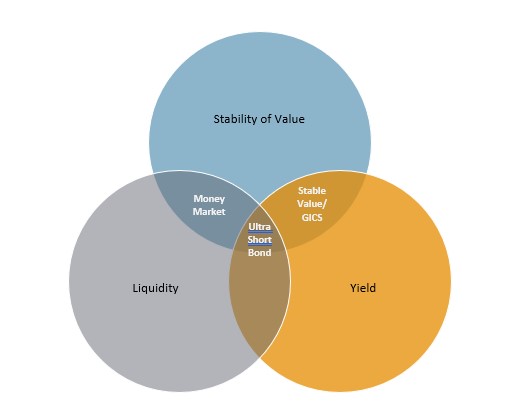

Like during the credit market crisis of 2008, plan sponsors will need to make decisions about the appropriate way to structure “cash equivalents” in their defined contribution menus. The structure of your cash equivalent should focus on prioritizing three factors.

- Daily Price Stability – Does the structure or guarantees assure participants that their value will not decline on any given day?

- Yield (return) – What is the long-term expected return of the investment structure?

- Liquidity – Are their limits on the participant or the plan in when they could liquidate the position?

Regrettably, the cash equivalent product structures in defined contribution plans carry tradeoffs.

While any approach can work in a defined contribution plan, all approaches have limitations and, when used together, typically confuse participants.

Money market regulations have changed materially since 2008 to the benefit of investors most concerned with liquidity and the potential for loss. However, the changes have dictated much shorter durations and higher-quality credit for money market managers. The impact of the changes are investment structures that have a negative real return (absolute return – inflation). Even as an instrument to dampen volatility, negative real return is an expensive insurance policy.

Ultrashort bond funds carry far more flexibility, allowing managers to extend the duration and pursue credit spread risk. However, in exchange for the opportunity for higher returns, these products lose the guarantee of a $1 share price. As a result, when rates increase, prices decline, and participants will experience short periods of time with a negative absolute return.

Stable value and Guaranteed Investment Contracts (GICs) carry risks understood by too few committees that elect to make them available. In these structures, participants bear counterparty risks, risks that the insurers providing the pricing guarantees may not be able to fulfill their obligations. Further, the complicated contract structures that drive these products frequently give tremendous latitude to the investment manager to restrict liquidity or even the plan design features you can adopt in the future.

With equity markets in turmoil, prudent plan sponsors would do well to allow the market to run this portion of the cycle and evaluate their equity positions with the benefit of hindsight and perspective. However, using this time to ensure that the cash investments that participants may flee to in times of turmoil continue to be appropriate for your participants is priority one.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice.