The CARES Act includes a provision to allow Coronavirus Related Distributions (CRDs) of up to $100,000. This can have a significant impact on the retirement readiness of a participant.

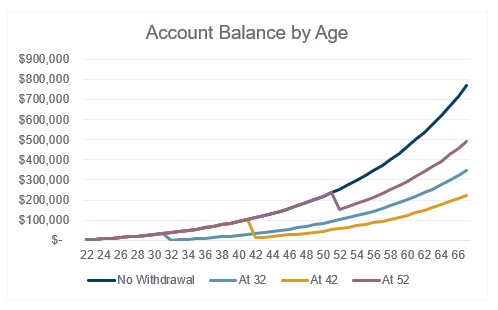

To illustrate, consider a participant who makes $50,000 a year, and has been diligently saving 5% of their income since age 22. The chart below shows the effect of a maximum CRD, depending on the participant’s current age.

- The 32-year-old takes the entirety of their balance, about $40,000, and has about $420,000 less at age 67.

- The 42-year-old also takes the full $100,000, leaving about $12,000 in their account. They’ll have $540,000 less at age 67.

- The 52-year-old takes the full $100,000, leaving about $150,000 in their account. They’ll have about $275,000 less at age 67.

The CRDs can be paid back to the plan over three years, but prior experience warns us that very few individuals are likely to pay back the CRD. Assuming the participants pay back the total distribution, there are still financial repercussions. At age 67:

- The 32-year-old would have $47,000 less

- The 42-year-old would have $73,000 less

- The 52-year-old would have $40,000 less

To download a PDF of this material, click the button below.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice.