On Monday, the U.S. equity market entered bear territory (a decline of 20%) as concerns continue to grow about the impact of inflation, the Fed’s policy to break the inflationary spiral, and a general repricing of equity assets based on a significant change in sentiment regarding the health of the economy.

While the pain has been relatively broad, the stocks that led markets during the pandemic have fallen precipitously during the current bear market. Some of the largest U.S. companies from the tech sector are now off far more than the 22% market decline of the S&P with Meta (Facebook) off 51%, Nvidia off 48%, and Apple, Alphabet, and Microsoft down more than 27%. All five of those stocks were up more than 125% during the pandemic bull market.

Each stock has a unique story, but it is also true that rising interest rates can impact the valuation of growth stocks significantly. The tech and communications sectors have benefited from a very low cost of capital, which has allowed them to continue to invest through periods of lower profitability. Further, the future value of profits are discounted less heavily when interest rates are low. Now with the cost of capital rising and the relative discount rates rising, valuations have been recalibrated.

With the recent bad inflation data and continuing strong employment market, the Fed raised rates another 0.75% today (6/15/22), the largest rate increase in nearly 30 years. While bold, the increase was in line with expectations and what has already been priced into the equity market.

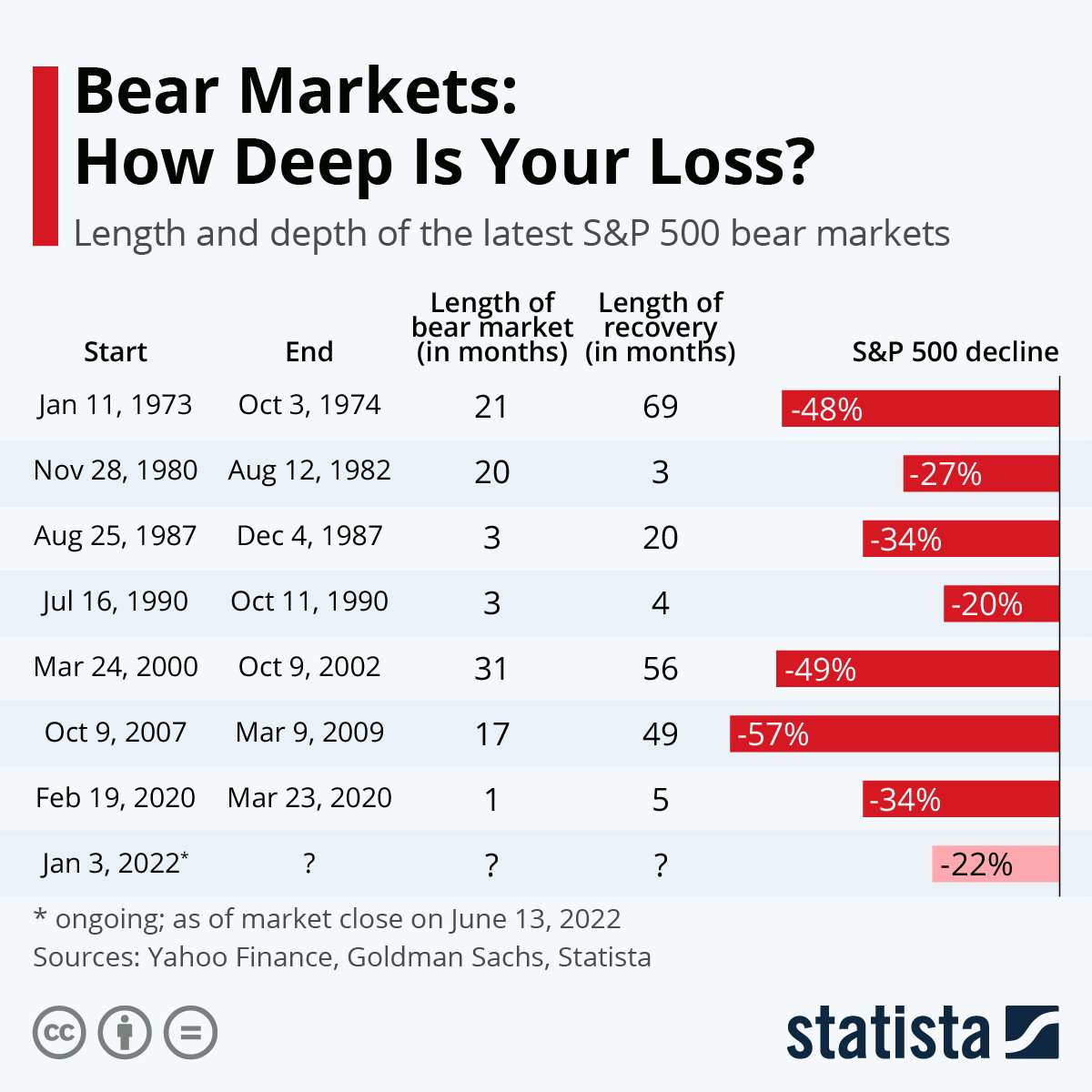

Bear markets are typically long and painful. Since World War 2 the average bear market has extended for 13 months and the recovery from the trough back to the prior highs has extended for another two years.

It is useful to some to know the context (on average how long / how deep / etc.) but trying to define action out of these averages is even more painful. When markets bottom, they tend to do so suddenly and over time the impact of missing the first days of the next up market cycle can be even more devastating to long-term returns than remaining patient and invested through the entirety of the cycle.

This time is never like last time, but, over decades of investing history each bear market, while unique in its depth, length, and origin, creates another opportunity for future growth.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice.