Economic Growth

The U.S. economy rose at an annualized pace of 2.1% in the second quarter of 2023, a slight decrease from the first quarter, when GDP rose 2.2%. Second quarter GDP reflected increases in consumer spending, municipal spending, and nonresidential fixed investment, while exports decreased. Third quarter GDP will be released on October 26.

Inflation & the Federal Reserve

Core CPI, which excludes food and energy prices, rose 4.1% for the 1 year ended September 30, down from 4.8% in June. The Federal Reserve’s preferred inflation measure, the Core Personal Consumption Expenditures Price Index (PCE), excluding food and energy prices, was up 3.9% for the same period. September data will be released on October 27, four days before the Federal Reserve’s next meeting. The Federal Reserve held rates steady at their September meeting, with rates at a range of 5.25%-5.5%. They continue their balancing act of meeting maximum employment while targeting a 2.0% inflation rate.

Employment & the Consumer

Nonfarm payrolls were surprisingly strong in September, rising by 336,000. (The average monthly gain over the preceding 12 months was 267,000.) The unemployment rate is at 3.8%, and wages grew at an annual rate of 4.2%. The Bureau of Labor Statistics also reported a month-over-month increase in job openings, with total openings at 9.6 million as of August 31.

Consumer confidence declined in September, continuing a trend from the prior month, as expectations continue to reflect consumers’ concerns about a potential recession.

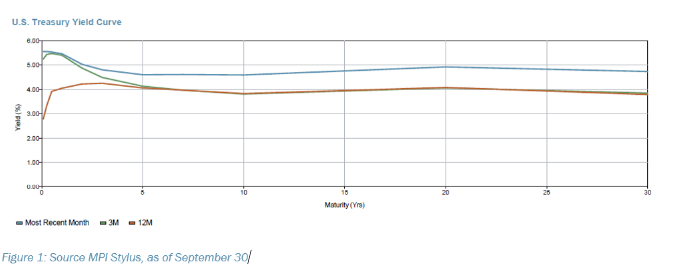

Fixed Income Markets

Yields rose during the quarter, reflecting a continued inversion at the beginning of the curve. As of September 30, the yield spread between 2-year and 10-year Treasuries was just under -0.5%. The yields on the 2-year, 10-year, and 30-year Treasury issues rose during the third quarter to end at 5.0%, 4.6%, and 4.7%, respectively. Fixed income returns were mostly negative for the quarter, with T-Bills, High Yield debt, and Short Government Credit the only sectors producing positive returns (up 1.4%, 0.5%, and 0.2%, respectively). The largest loss was in Long Government/Credit, down 9.4% for the period.

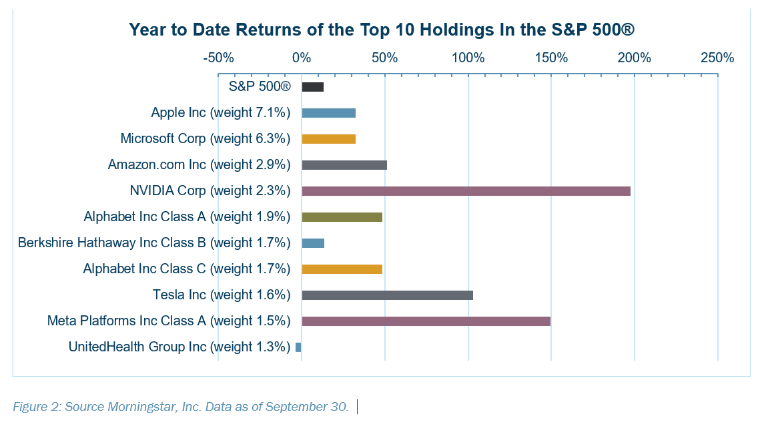

Equities Markets

The S&P 500® was down 3.3% for the third quarter, with only two of 11 sectors producing positive returns. Energy was up 12.2%, while communication services were up a more modest 3.1%. Utilities was a leading detractor, down 9.2%, followed by an 8.9% decline in real estate. Equities returns were negative across the style and market capitalization spectrum; small growth saw the largest decline, at -7.3%, while small value had the best absolute return at -3.0%.

For the year-to-date, performance continues to be driven by the top holdings of the S&P 500 ®.

U.S. markets led developed international markets in the third quarter. The MSCI World ex-USA Index, which includes developed countries, was down -4.0%, while the MSCI ACWI ex-USA Index, which includes both developed and emerging market countries, returned -3.7%. All regions were down, with Europe ex-U.K. at the bottom with a return of -5.9%. On an absolute basis, Japan was the leader, down 1.4%. Emerging Markets (EM) equities were down 2.8%, on an absolute basis, besting the return of the S&P 500® and both international indices.

Outlook

All eyes are on the Federal Reserve’s October 31-November 1 meeting. The Fed is seeking a balance between employment numbers and inflation rates, both remaining strong on lagging indicators. There are growing concerns that the Fed may go too far in raising interest rates, which, combined with banks’ more stringent lending requirements, may stifle economic growth and tip the U.S. into a recession.

The markets are faced with further uncertainty: Congress’ negotiations on a new spending bill, with the current extension expiring November 17. Geopolitical risks also remain as Central Banks globally balance the fight against inflation with the possibility of a recession. The wars in Ukraine and the possibility of a protracted war in Israel could also impact markets. Combined with signs of slowing growth in China and the possible collapse of their real estate market, there may be more volatility ahead.