Inflation & the Federal Reserve

The Federal Reserve held rates steady in their December meeting as they continued to monitor the economic effects of steep rate increases in 2022 & early 2023.

Core CPI, which excludes food and energy prices, rose 3.9% in the 12 months through December, down from 4.1% in September and 5.7% in December 2022. The Fed’s preferred inflation measure, the Personal Consumption Expenditures Index, showed inflation slowing to 2.6% over the past 12 months ended November 2023. (December PCE will be released on January 26.)

The effective Fed funds rate currently holds at 5.33%. Fed guidance suggests three rate cuts in 2024, potentially starting in May. This activity would likely see the rate drop to about 4.7% by year end. Market consensus appears to favor more rate cuts starting earlier and deeper, reaching a rate of just over 3.8% by December 2024.

Economic Growth

The U.S. economy rose at an annualized pace of 4.9% in the third quarter; an increase from the second quarter, which saw GDP rise 2.1%. (Fourth quarter GDP will be released on January 25). The third quarter increase was attributable to increased consumer spending, private inventory investment, municipal spending, federal government spending, and residential and nonresidential fixed investments. Imports and exports also increased.

Employment & The Consumer

Nonfarm payrolls rose by 216,000 in December 2023. The unemployment rate was at 3.7%, a slight increase from December 2022, when the rate stood at 3.5%. In November (the most recent release), job openings were at 8.8 million, down from 10.8 million in November 2022.

January’s Surveys of Consumers from the University of Michigan showed that consumer confidence is building; the Index of Consumer Sentiment hit 78.8, representing a 21.4% increase from one year prior. The survey gauges consumer sentiment on personal finances and short- & long-term health of the general economy.

Fixed Income Markets

The Bloomberg U.S. Aggregate Bond Index returned 6.8% in the fourth quarter, led by Long Government Credit, Developed International Bonds, and Emerging Markets debt. These sectors were up 13.2%, 10.0%, and 9.3%, respectively. After a disastrous 2022, which saw the Aggregate Bond Index down 13%, the benchmark returned 5.5% for 2023. All sectors of the benchmark saw positive returns, with High Yield up the most at 13.4%.

The yield curve remains modestly inverted, with yields on the 2-year Treasuries at 4.2%, 10-year Treasuries at 3.9%, and 30-year issues at 4.0%. This has been a volatile year for the curve, particularly within the fourth quarter, which saw Treasury yields at 5.07% on the 2-year, 4.88% on the 10-year, and 5.04% on the 30-year Treasury in October. Yields varied widely on speculation regarding Fed moves.

Equities Markets

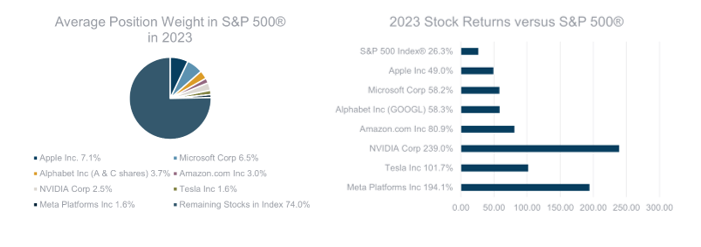

For the year, the S&P 500® returned 26.3%, led by technology stocks, up 57.8%, and communication services stocks, up 55.8%. On a market cap and style basis, large-cap growth saw the largest returns, up 42.7%. Two sectors saw negative returns for the period: energy (down 1.3%) and utilities (down 7.1%). For the quarter, the S&P 500® was up 11.7%, led by real estate, up 18.8%, and technology stocks up 17.2%. Technology stocks saw gains as the market anticipated the possibilities of AI for these companies.

As mentioned in previous quarters, outperformance has been narrow. The Magnificent Seven stocks (Apple, Alphabet, Amazon, Meta, Microsoft, NVIDIA, and Tesla) were up between 49% and 239% in 2023, compared to a return of just 26.3% for the S&P 500®. Returns concentrated in a handful of positions can be a concern for active managers with concentrated positions in stocks that returned less and for “diversified” managers whose single stock weights are bound by SEC rules.

U.S. equity markets outperformed international and emerging markets during the fourth quarter. The MSCI World ex-U.S.A. index, which includes only developed international companies, returned 10.6%. The MSCI All Country World (ACWI) ex-U.S.A. index, which includes emerging markets, returned 9.8%. Emerging markets equities were up 7.9%, with all regions seeing gains.

For the year, U.S. equity also outperformed developed and emerging markets. The MSCI World ex-U.S.A. was up 18.6%, while the MSCI ACWI ex-U.S.A. index was up 16.2%. Emerging markets lagged, returning 10.3% for the period. Latin America’s returns were the strongest, up 33.5%, while Asia struggled on a relative basis at 8.2%.

Outlook

All eyes remain on the Federal Reserve, with their next meeting scheduled for January 30-31. Fixed income markets will be closely eying Fed remarks for hints of rate movements in 2024.

The election year and congressional budget negotiations are an additional concern. President Biden signed a continuing resolution to allow more time for federal budget negotiations with a March deadline. The federal budget for 2023 totaled $6.1 trillion.

Wars in Ukraine and Gaza raise concerns about the global energy supply. In response to Israel’s actions in Gaza, militants are targeting shipping through the Red Sea, heightening global logistics issues.

With inflation easing and fewer signals pointing to a recession resulting from the Fed’s aggressive rate hikes, consumer concerns are easing. Unemployment is low, and consumers are generally feeling positive about their personal finances and the economy.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice.