Inflation & the Federal Reserve

The Federal Reserve held rates steady at a range of 5.25-5.5% in its March meeting. The Fed noted a solid economy and low unemployment, and while inflation remains above the Fed’s 2% target, it is easing.

Core CPI, which excludes food and energy prices, rose 3.8% in the 12 months through March, down slightly from 3.9% in December and down significantly from 5.6% in March 2023. The Fed’s preferred inflation measure, the Personal Consumption Expenditures Index excluding food and energy, showed inflation slowing to 2.8% over the past 12 months ended February 2024. (March PCE will be released on April 26.)

The Fed is being cautious on potential rate cuts. In remarks following the March meeting, they stated “The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.” Late last year, with the assumption that inflation numbers would continue to cool at a more heightened pace, the market priced in aggressive rate cuts in 2024, estimating four cuts totaling about 100 basis points. In light of Fed remarks and as inflation numbers continue to come in stronger than expected, the market has pared its rate cut predictions for 2024, now favoring the possibility of two rate cuts starting in the second half of 2024 and reducing expectations to 50-60 basis points of cuts.[1]

Economic Growth

The U.S. economy rose at an annualized pace of 3.4% in the fourth quarter, a decrease from the third quarter of 2023, which saw GDP rise 4.9%. (First quarter GDP will be released on April 25). The fourth quarter increase was driven by increased consumer spending, municipal and federal government spending, and residential fixed investment. Imports also increased.

Employment & The Consumer

Nonfarm payrolls rose by 303,000 in March 2024. The unemployment rate was at 3.8%, slightly up from March 2023 when the rate stood at 3.5%. For February (the most recent release), job openings were at 8.8 million, down slightly from 9.0 million in December.

The Surveys of Consumers from the University of Michigan gauges consumer sentiment on personal finances and short- & long-term health of the general economy. April’s report showed consumer confidence up 28.1% from one year ago as consumers see signs that inflation is easing and continued stability in the economy. However, the University of Michigan’s researchers note that consumer outlook could become volatile in the months ahead as the election season ramps up.

Fixed Income Markets

The Bloomberg U.S. Aggregate Bond Index returned -0.8% for the first quarter. Most fixed income sectors declined, led by Developed International Bonds, Long Government Credit, and Treasuries (down 4.4%, 2.4%, and 1%, respectively). Cash, High Yield, Short Government/Credit, and Emerging Markets Debt were the only positive sectors. For the one-year period, the U.S. Aggregate Bond Index was up 1.7%, led by returns in High Yield (up 11.1%), Emerging Markets Debt (up 9.5%), and Cash (up 5.6%). Developed International Bonds and Long Government/Credit detracted. Agency MBS returns remain under pressure as the Fed reduces its balance sheet.

The yield curve remains modestly inverted, with yields on 2-year Treasuries at 4.6%, 10-year Treasuries at 4.2%, and long-term Treasuries at 4.3%. Yields have continued to move with market sentiment on Fed remarks.

Equities Markets

For the quarter, the S&P 500® Index was up 10.6%, led by the communications services sector. Real estate was the only sector to post a negative return, down 0.5%. Energy stocks were up this quarter, posting a return of 13.7%. Returns were concentrated in the Oil, Gas & Coal industry as the market sees supply constraints on geopolitical tensions and production cuts by OPEC. For the one-year period, the Index returned 29.9%, led by strong gains in communication services (49.8%) and technology (46.0%). All sectors posted positive returns for the period.

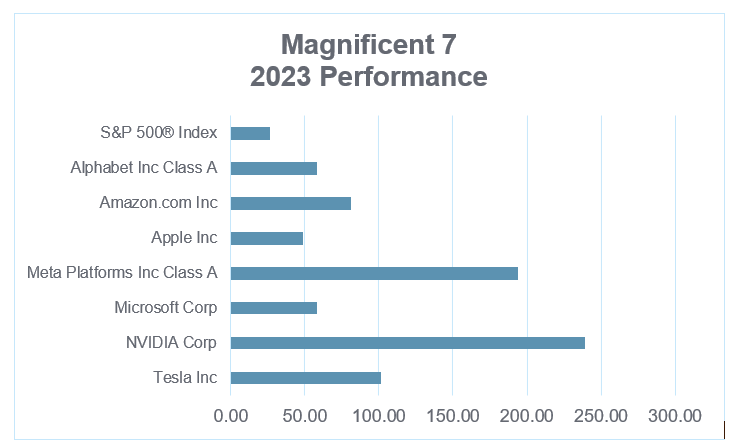

2023 was the story of the “Magnificent Seven” – Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla. These stocks represented 26% of the S&P 500® Index and saw head-turning returns with Alphabet up 58.3%, Amazon up 80.9%, Apple up 49.0%, Meta up 194.1%, NVIDIA up 239.0%, and Tesla up 101.7%.

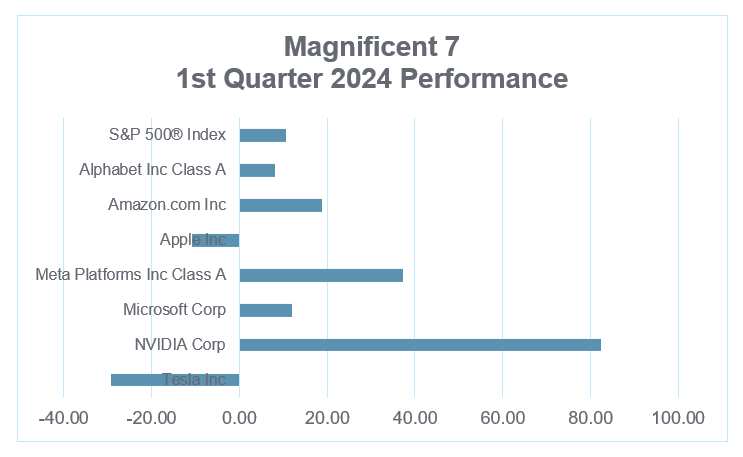

In the start of 2024, we’ve seen some weakening of returns, particularly Tesla (down 29.3%) and Apple (down 10.8%). Alphabet underperformed the Index by 2.5%. NVIDIA and Meta strongly outpaced the Index, posting returns of 82.5% and 37.3%, respectively, for the quarter. NVIDIA & Meta both experienced a strong tailwind on advancements in artificial intelligence.

U.S. equity markets outperformed international and emerging markets during the first quarter. The MSCI World ex-U.S.A. Index, which includes only developed international companies, returned 5.7%. The MSCI All Country World (ACWI) ex-U.S.A. Index, which includes emerging markets, returned 4.8%. Emerging markets equities were up 2.4%, led by EM Asia (up 3.4%). EM Latin America was the only region to post negative returns, down 3.9%.

Outlook

The market continues to closely monitor Fed remarks for signs of rate cuts ahead. While the market is expecting two rate cuts this year, the Fed is being more cautious in their comments. The next Fed meeting is April 30 - May 1.

Earnings per share have increased over the quarter as markets softened their views on the potential for a recession and as AI advancements provided a tailwind to equities, particularly in the technology and communication services sectors. The forecasted P/E ratio for the Russell 1000® Index was 25.1x earnings; the Russell 1000® Growth Index was trading at 27.9x earnings and the Value Index at 16.2x, above their long-term averages.

We may see greater market volatility as we get closer to national elections. Traditionally, election rhetoric places an emphasis on the federal budget and the health of the economy, raising the profile of these issues with consumers.

Notes:

[1] Ritchie, G. and Capo McCormick, L. (2024, April 8). Treasury Yields at Year’s Highs Draw Buyers Despite Fed Rethink. https://www.bloomberg.com/news/articles/2024-04-08/traders-lean-toward-two-quarter-point-fed-rate-cuts-in-2024

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice.