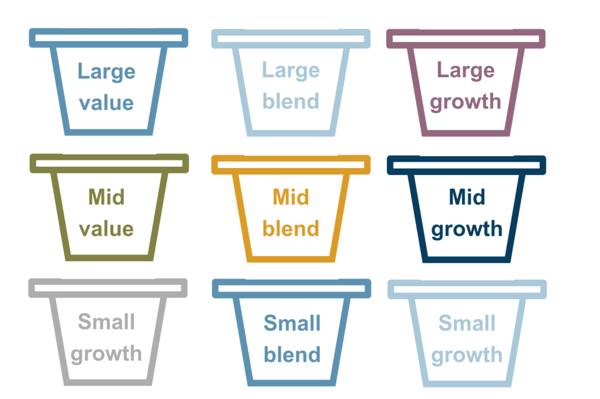

Morningstar established its ‘style box’ nearly 30 years ago. Since then, the style box has become the primary method for classifying stock mutual funds by investment advisors. Morningstar’s style box uses two main factors – size and style scores. Size scores are calculated using scaled market capitalization of each underlying holding and the style score uses multiple financial metrics of each stock. Using these two characteristics, the investment industry has classified U.S. equity mutual funds into one of nine buckets.

Actively-managed equity mutual fund managers have more nuance to them than just two distinguishing factors (size and style), and much academic research has been conducted in the intervening years to seek additional characteristics that help to explain investment management styles and resulting performance differences. As a result, Morningstar is introducing the ‘factor profile’ as a new tool for analyzing equity funds. The new tool will add five new factors - yield, momentum, quality, volatility, and liquidity.

- Yield – trailing 12-month dividend and stock buy-back yields

- Momentum – capturing the tendency of recent performance to persist (both good or bad)

- Quality – measured by profitability and financial leverage ratios

- Volatility – 12-month fluctuation of daily returns

- Liquidity – measured by average daily trading volume

With these additional measures, investors will have more data points for categorizing equity mutual funds. An investor will be able to distinguish between two large cap growth managers to see which tend to have a higher quality basis versus those that seek to purchase high momentum stocks. This will allow the investor to more precisely implement their views through the funds they choose to utilize.

As an investment consultant, I welcome the new tool for communicating nuances between funds within the same style box. These additional factors will provide us with more data points for confirming if a manager is selecting stocks that are true to their stated philosophy and process. We have long used terms like traditional growth, growth-at-a-reasonable price, momentum growth, growth-at-any-price, etc. to describe different types of growth equity funds managers. With these additional factors, the subtleties between managers and the consistency with their stated process should become more transparent to investors.

Additionally, I am intrigued to see how these new tools integrate into defined contribution plans to the benefit of participants. Currently, many participant communication programs rely heavily on the the legacy Morningstar style box methodology. Will communication tools adopt this finer lens for communicating investment options to participants? Or will this type of information be required by participants given the heavy usage of target date funds now and heading into the future? Time will tell.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice.