The Economy

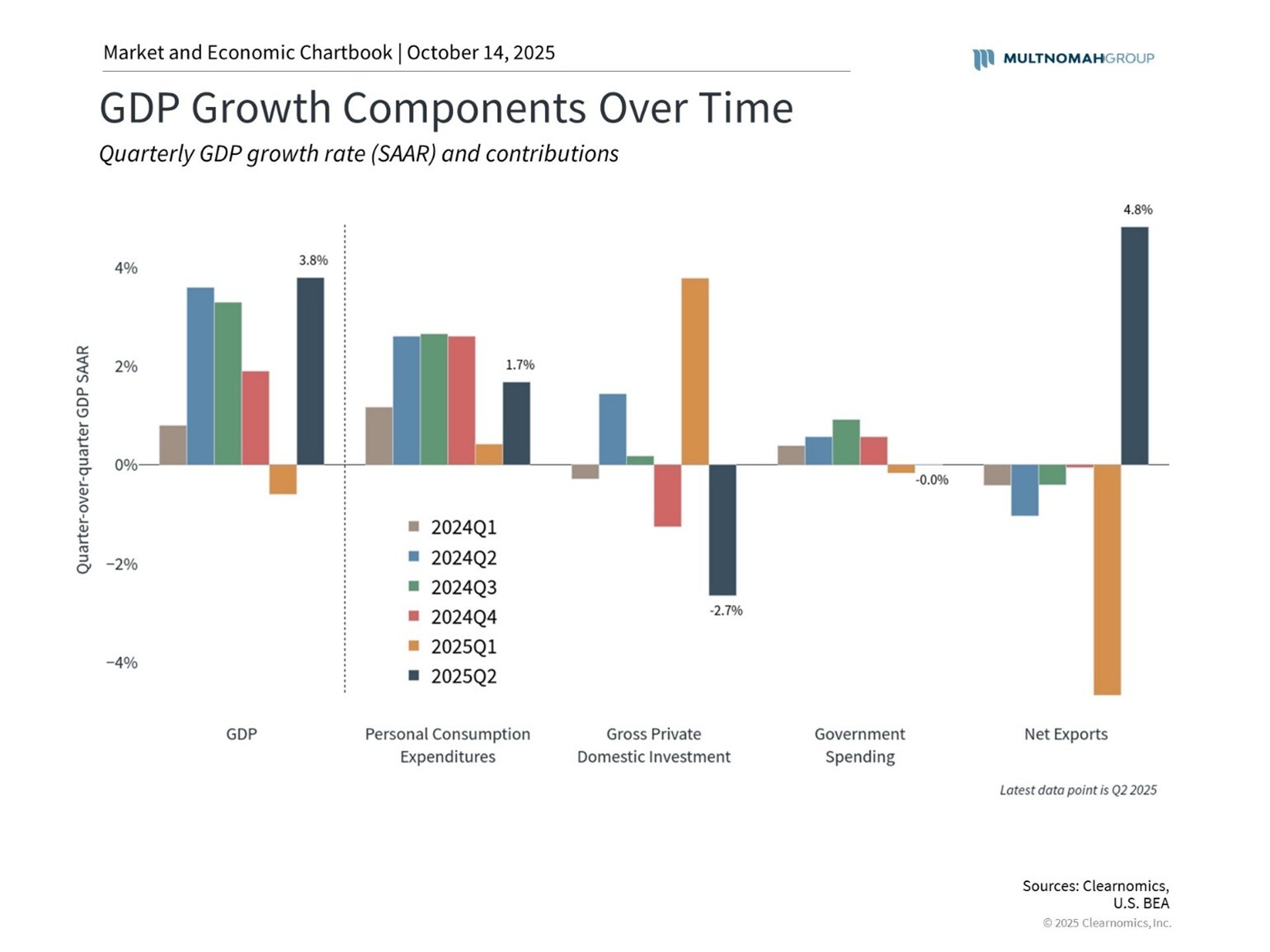

In the second quarter of 2025, the U.S. economy rose at an annualized pace of 3.8%. The quarter’s growth was driven by a decrease in imports and an increase in consumer spending. This is a reversal of activity in the first quarter, when GDP declined 0.6%, driven largely by an increase in imports as businesses sought to get ahead of tariff increases. (Third quarter GDP will be released on October 30.)

Nonfarm payrolls rose by 22,000 in August (the latest figure available); wages grew at an annualized rate of 3.7% and unemployment sat at 4.3%. While unemployment has risen only modestly since last quarter, there has been a slowdown in the growth of payrolls, raising some concern about a weakening labor market.

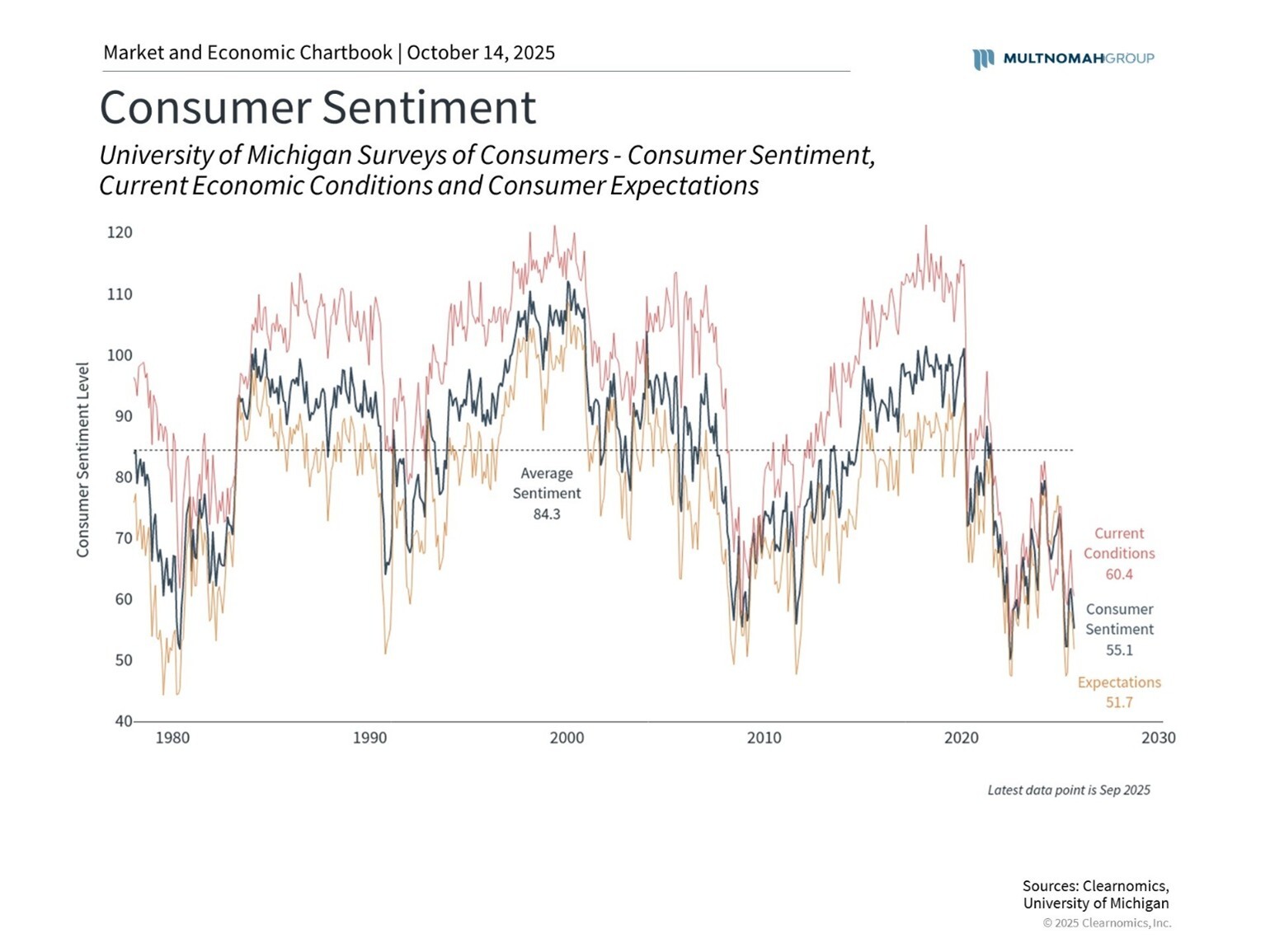

Consumer sentiment regarding the economy, inflation, and personal finances continues to decline. The University of Michigan’s Surveys of Consumers found that the Index of Consumer Sentiment declined 21.4% over the last 12 months through September. However, sentiment differed between consumers with larger stock holdings, where sentiment held steady, while those with smaller or no stock holdings reported a decline. Most of the decline in sentiment was driven by changes in consumer expectations, as those surveyed had a weakening outlook for their incomes and personal finances. Consumers also highlighted frustration with persistent inflation.

As consumers noted, inflation has been sticky. Through August, the Core Consumer Price Index, which excludes food and energy prices, rose 3.1% annualized. Core Personal Consumption Expenditures, the Federal Reserve’s preferred measure of inflation, rose 2.9%. The Fed has long targeted an annualized inflation rate of 2%. There are some indications that tariff impacts are beginning to impact prices; however, the effect has, to date, been more muted than many feared. Fed comments indicate a view that tariffs’ impact on inflation will be transitory as consumers become accustomed to higher prices.

Fixed Income Markets

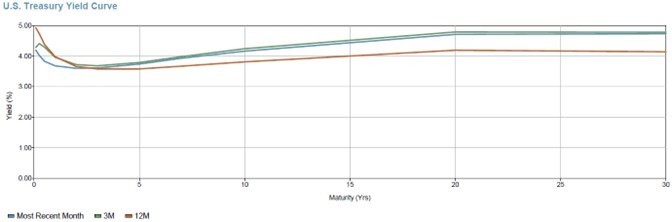

After a several-month pause, the Fed cut rates 0.25% at its September meeting, bringing the target federal funds rate to a range of 4.0% to 4.25%. The Fed will meet twice more this year, in October and December.

As of September 30, the yield on 2-year U.S. Treasuries was 3.6%. The yields on 5- and 10-year maturities stood at 3.74% and 4.16%, respectively. The yield on 30-year Treasuries stood at 4.73%. There was some volatility during the third quarter leading up to the Fed’s September meeting, as the market absorbed the latest employment and inflation numbers and tried to predict the Fed’s movement.

For the quarter, the Bloomberg U.S. Aggregate Bond Index rose 2.0%. Most sectors posted gains, led by Emerging Markets Debt, up 4.4%, and Long Government/Credit, up 3.2%. Developed International Bonds was the only negative sector, down 1.5%. This is a reversal from last quarter, when Developed International Bonds led returns.

For the year through September 30, the Bloomberg U.S. Aggregate Bond Index returned 2.9%, led by Emerging Markets Debt, up 7.8%, and High Yield, up 7.3%. Long Government/Credit and Developed International Bonds were the only sectors posting negative returns for the period, down 1.3% and 0.4%, respectively.

Equity Markets

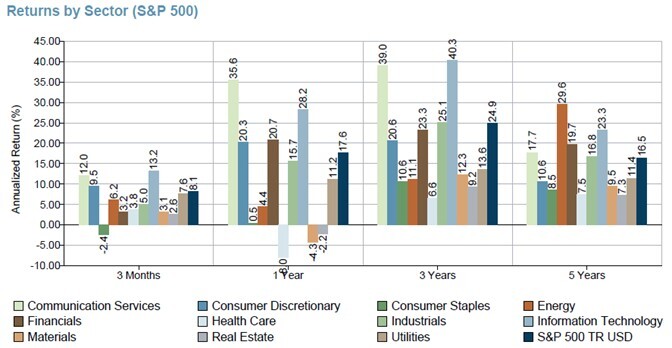

The S&P 500® Index was up 8.1% for the third quarter, led by Technology and Communication Services. As the market continues to focus on stocks benefiting from the growth in artificial intelligence, Technology was up 13.2% and Communication Services up 12.0%. Consumer Staples was the lone sector to post a negative return, down 2.4%.

The AI rally has had legs, which is reflected in the one-year returns as Communication Services, up 35.6%, and Technology, up 28.2%, led sector results. For the same period, Health Care, Materials, and Real Estate posted negative returns, down 8.0%, 4.3%, and 2.2%, respectively.

Small Cap stocks benefited the most from the third quarter’s market rally, with Small Cap Value leading size and style returns, up 12.6%. Mid-Cap Growth stocks lagged the most, up just 2.8%. For the one-year period, Large Cap Growth stocks posted the largest returns, up 25.5%, followed by Mid-Cap Growth, up 22.0%.

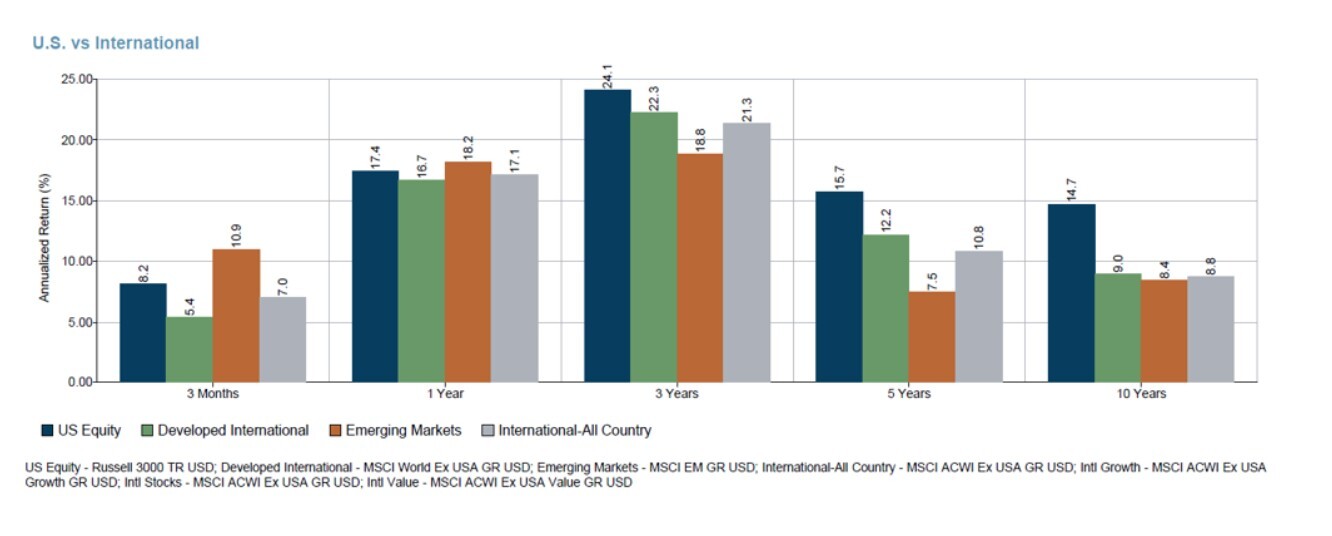

Looking out globally, Emerging Markets saw another strong quarter, returning 10.9%. EM outperformed both U.S. Equity (up 8.2% as represented by the Russell 3000® broad market index) and Developed International Markets, up 5.4%. EM Asia led regional returns during the period, up 11.3%, followed by EM Latin America, up 10.3%. Europe ex UK lagged, returning 3.0% for the quarter.

For the one-year period, EM’s performance also led returns, up 18.2%, versus 17.4% for U.S. Equity and 16.7% for Developed International markets.

Outlook

The federal government shutdown began on October 1; the shutdown extends to the Bureau of Labor Statistics (BLS), which produces the CPI data on which the Fed relies. At this time, a number of BLS staff have been called back to generate the September CPI report; however, it will be delayed until shortly before the Fed’s next meeting, October 28 and 29. The shutdown is also expected to impact employment data from the BLS. A lack of access to official data and conflicting informal data from outside sources could cause some volatility as we draw closer to the next Fed rate decision.

The Fed has the difficult job of balancing the economy, inflation, and employment. While inflation is persistently higher than the Fed’s target rate of 2% and tariff impacts on prices are still being measured, employment numbers seem to be weakening as August’s nonfarm payrolls came in lower than market expectations. However, Treasury market futures trading shows an expectation of two rate cuts remaining this year. Comments from Fed members are more circumspect, but reflect an openness to near-term cuts.

The holiday shopping season is nearly upon us. Many retailers stockpiled inventory earlier this year, in anticipation of higher tariff rates, and consumer spending has remained strong so far this year. However, as the University of Michigan Surveys of Consumers shows, consumers are losing patience with price increases and growing more concerned about the state of their personal finances. The market will be watching retail sales closely for clues.

Multnomah Group is a registered investment adviser registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice.