Recently, Fidelity made headlines by cutting the fees on a number of their index mutual funds in a targeted effort to undercut Vanguard’s price for similar investment strategies. At the same time, for their retail clients, they launched two new zero-fee index funds for U.S. and international stocks. Fidelity’s efforts are designed to compete directly with Vanguard, whose low-cost service model has attracted the majority of new fund inflows in the industry and grown the firm to the second largest asset manager in the world with $4.94 trillion in assets according to Pensions & Investments.

So, how does Fidelity’s price cut affect plan fiduciaries? Well, it kind of depends on your circumstances, but there are a few common issues that all plan fiduciaries should evaluate.

Offer Index Funds

If you haven’t already done so, hopefully, Fidelity’s latest price cut will cause you to evaluate adding index funds to your investment menu. The active-passive debate is ongoing and likely never to be settled, but we would recommend all clients include at least a handful of low cost, index funds within their investment menu. As costs continue to decline, and actively managed funds on average underperforming, it is prudent to provide passive choices to participants.

Evaluate Your Index Funds

If you offer index funds, evaluate the existing options that are available in your plan. In our experience, index funds have frequently been overlooked by investment committees because of their plain-vanilla approach to investing and their consistent relative performance (they don’t tend to outperform or underperform significantly). If you haven’t looked at them in a while, take a look at what you have to see if they still make sense. In the coming weeks, look out for a blog post on how to evaluate your index funds.

Keep Costs in Perspective

Lastly, I encourage all plan fiduciaries to keep costs in perspective. Plan fiduciaries should work to ensure that the costs that are paid by the plan are reasonable in light of the services that the plan receives, and they should always look to identify opportunities to reduce fees paid by participants. At the same time, the investment management market is dynamic with index and other providers changing prices frequently. It can quickly become an all-consuming activity for the fiduciaries to chase the lowest cost option, making changes as each provider responds to the last provider’s price cut. In most cases, if you have reasonably priced index funds, the current reduction will have a limited impact on any of your participants’ ability to retire successfully.

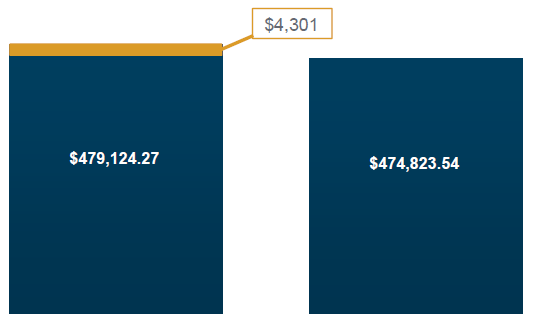

To understand what I mean, let’s look at two different scenarios. In the first scenario, we have a participant starting out in the working world making $40,000 per year and saving 6% of pay. Over 40 years, if they earn a 7% net rate of return their savings will have grown to $479,124, assuming no changes in salary or savings behavior. Assuming they invest in a slightly more expensive index fund that may cost 0.035% more than the cheapest alternative their net of fee return may decline to 6.965% annually. In this case, all other things equal, that person will accumulate $4,301 over their working life.

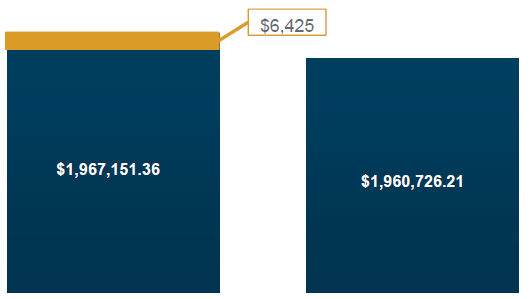

In the second scenario, we look at a later stage worker who has accumulated $1,000,000 as they near retirement. Assuming they may be getting closer to retirement, we forecast the difference in growth of their assets between the two index funds assumed above in the first scenario and over ten years the difference in accumulation is $6,425. In either scenario, the difference in accumulation is not likely to be the difference between whether your participants can retire successfully or not.

There are three main levers in play to determine a successful retirement outcome: savings rate, growth rate, and time horizon. Growth rate can be impacted by the costs of the investment options but when we are comparing differences that are hundredths of a percentage point the differences are minimal. Conversely, being able to increase an investors time horizon by encouraging them to start early or increasing their deferral rate can have a more material impact on an investor’s success. Using the assumptions in scenario 1, increasing the assumed deferral rate from 6% to 6.5% will result in almost $40,000 more in accumulated assets over that investor’s working life.

All of this is to say that plan fiduciaries should keep fees in perspective. They should have a process to determine reasonable fees and look for opportunities to lower expenses when available. At the same time, these activities should not become the sole or primary focus as there are other ways that they can have a greater impact on participants’ success.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice.

Any views expressed herein are those of the author(s) and not necessarily those of Multnomah Group or Multnomah Group’s clients.