One of the more requested investments over the past several years has been in the area of Environmental, Social, and Governance (ESG) focused funds. Product offerings in the ESG space have certainly matured into a now robust area with numerous high-quality funds in the marketplace. Furthermore, the strong performance of many of these offerings continues to build momentum for the ESG space. In this blog post, I would like to provide an overview of how these types of funds may be different than the general equity market. In order to do this, I will focus on looking at ESG funds from both a holdings and a linear-regression based analysis.

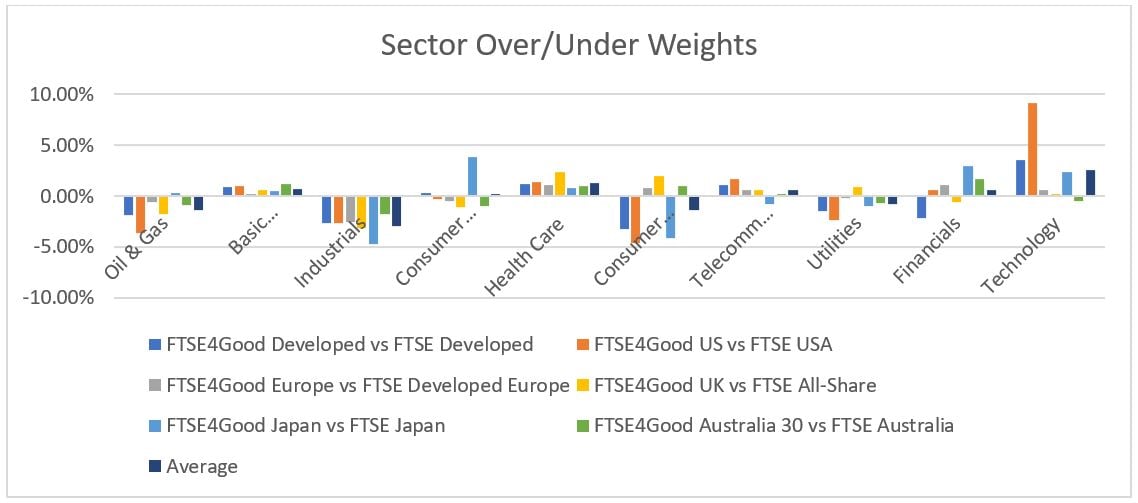

To begin, I retrieved the latest fund fact sheet from FTSE Russell for their series of FTSE4Good Indexes. The first item to note is that these funds are invested in large cap stocks. Second, these funds tend to on average, although not uniformly, have certain sector biases such being underweight Oil & Gas and Industrials, which is not terribly surprising given the E in ESG. The one sector exposure that jumps out is the large overweight to technology within the FTSE4Good US index.

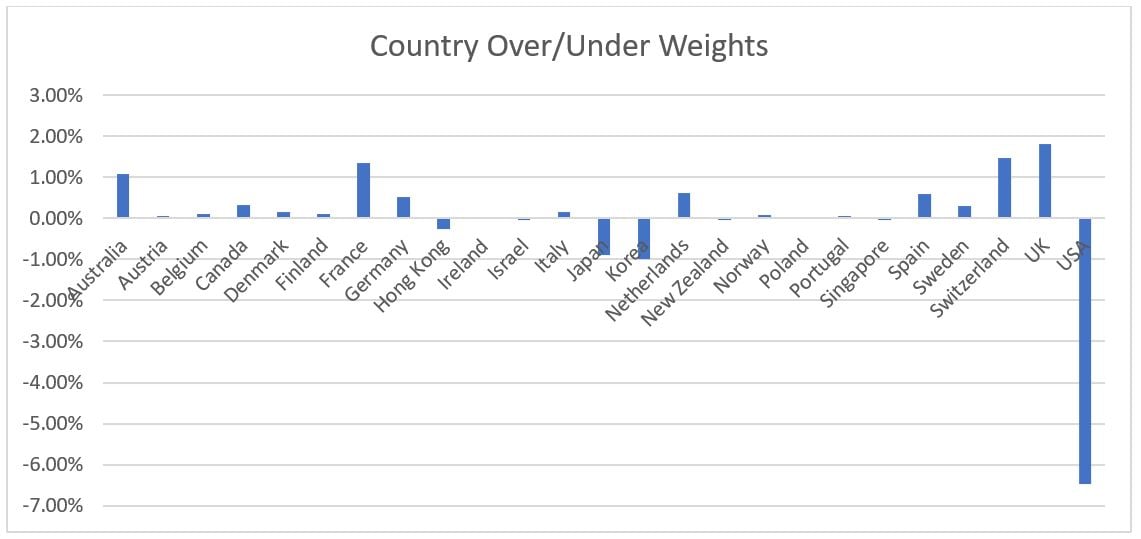

In addition to the sector over/under weights above, I also looked at the country over/under weights for the FTSE4Good Developed against the FTSE Developed index.

It is interesting to note that the U.S. is underweight by multiples of any other country is either over or under weight…

Besides a holdings-based review, what follows is an overview of the factor tilts that these indexes exhibit. The graph below is a 24-month rolling factor analysis for the Vanguard FTSE Social Choice fund, which is benchmarked to the FTSE4Good U.S. Select Index.

The above graph shows that the primary exposure for this Vanguard fund is the U.S. equity market, which is to be expected given its investment mandate of providing U.S. equity exposure. This fund, however, also has exposure to couple factor tilts. It is a large-cap fund, meaning that it is by construction underweight small caps, which the above graph confirms. More interesting is that this fund rotates back and forth between being overweight value or growth, with the fund being underweight value and overweight growth since early 2015 (and trending this way since 2013). This overweight to growth since 2015 confirms the most recent holdings-based review provided earlier, which showed the overweight to technology stocks.

I would be interested in digging further into the universe of ESG funds to decipher whether the above review is consistent across fund families. In other words, are ESG funds consistently overweight technology? How do they take into consideration style factors? My hunch is that the E in ESG tilts these funds away from certain sectors such as Oil & Gas; however, I am not as certain about other sectors and style factors.

Many of these products have performed well over the past several years. Those marketing these products would like for us to believe that it is due to the ESG mandate, and maybe it is. However, and at least based on the small number of anecdotes provided in this blog, performance over the past several years also seems to have benefited from the tailwinds of technology, large-cap, and growth.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice. Any views expressed herein are those of the author(s) and not necessarily those of Multnomah Group or Multnomah Group’s clients.