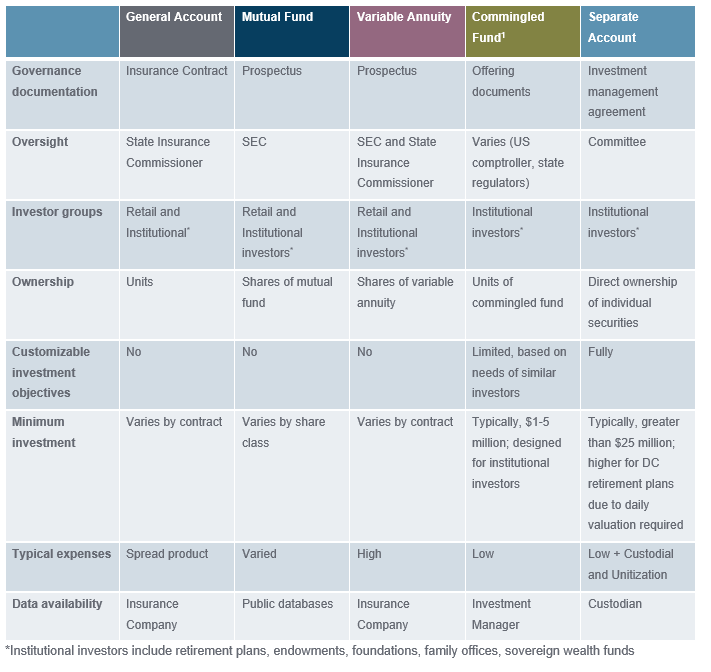

This is the third post in a series on investment menu design topics. This post will focus on the investment vehicles that are available to defined contribution plan participants. The table below summarizes some of the key traits of the various vehicles:

A few observations of note:

- Each investment vehicle has associated minimum investments. The minimums will differ by investment manager, but generally as plan assets increase, a committee will have more vehicle options.

- As you move from right to left, on the table, the level of transparency regarding the investment strategy pursued and holdings increases.

- General account investments are often referred to as ‘spread products.’ They offer participants a guaranteed fixed rate of a return for a specific period. The insurance company managing the portfolio manages a portfolio of securities. In lieu of collecting an expense ratio, the product’s fee is the difference between the underlying portfolio return and guaranteed rate of return credited to participant accounts.

- Separate accounts typically offer the lowest investment management fees, but they come with additional complexity. Separate accounts decouple the all-in fee and service structure of the other vehicles. They typically offer lower all-in fees and greater customization compared to other vehicles included in the chart above, particularly as assets grow, but these traits come at the cost of increased operational complexity. The committee will need to secure additional services to support the operation of this vehicle (i.e. custody, communications, legal, and oversight).

From a consulting process perspective, we focus our research on a firm’s investment strategy and then seek to understand what vehicles may be appropriate for our clients. There is no one right decision when it comes to investment vehicle selection. As we work with committees, we seek to help them determine the appropriate investment strategy and then understand benefits of each available vehicle.

Notes:

[1] Commingled funds or commingled investment trusts (CIT) are pooled investment vehicles offered to institutional investors that for defined contribution plan sponsors invest in traditional investment strategies (i.e. fixed income, stocks, multi-asset class strategies, etc.).

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice. Any views expressed herein are those of the author(s) and not necessarily those of Multnomah Group or Multnomah Group’s clients.