In my last post I discussed some of the fundamental beliefs that serve as the starting point for our work with retirement plan committees when building investment menus for their plan participants. These include:

- Less is more

- Costs matter

- Not all participants are the same

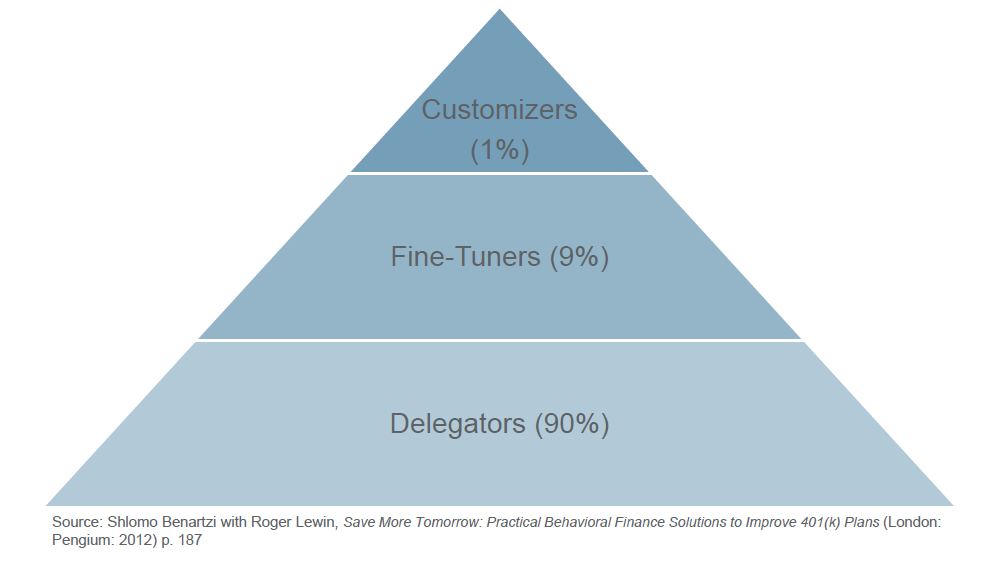

This post focuses on how investment options are grouped and placed into defined tiers so that committees and their recordkeeping partner can effectively communicate the role of each investment to participants. A quick aside, Shlomo Benartzi’s, a behavioral economist, research showed that participants can be segmented into three categories: delegators (90%), fine-tuners (10%) and customizers (1%).

Participant interest in developing investment portfolios ranges from ‘none’ to ‘a lot’ as you move from delegators to customizers. This point highlights the importance of an effective communication program so that participants are able to select the appropriate tier for them.

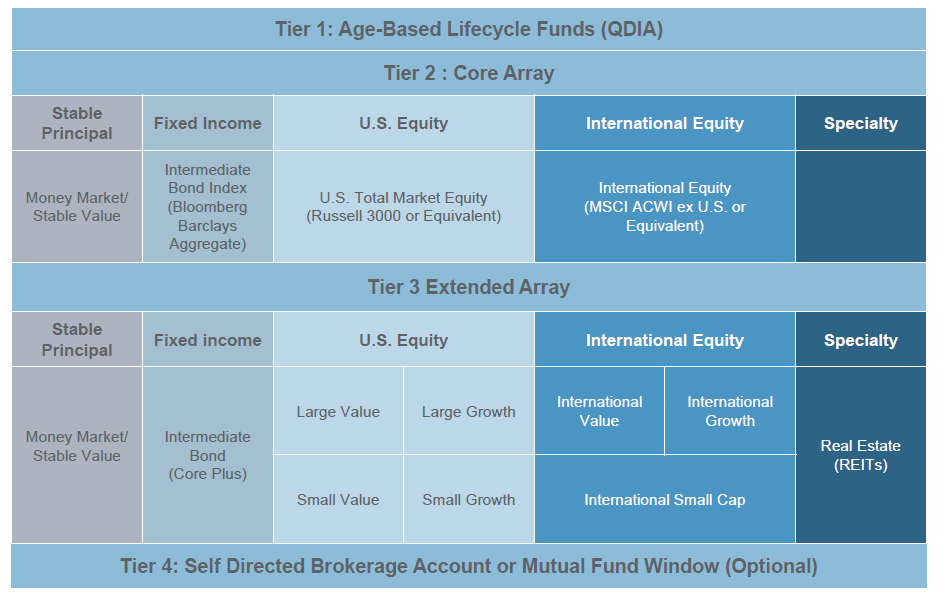

Our best practice defined contribution investment menu has investment options segmented into four tiers.

- Tier 1 – Target Date Funds

- Tier 2 – Core Array

- Tier 3 – Extended Array

- Tier 4 – Self-directed Brokerage Account or Mutual Fund Window (optional)

The first tier consists of a series of target date funds. These funds are designed to be used by the retirement plan’s ‘delegators,’ the largest segment of participants, and typically serve as the plan’s QDIA. (A key provision of the Pension Protection Act of 2006 established QDIA (Qualified Default Investment Alternative). This provision provided plan sponsors a framework for the selection of default investments and reduced concerns about legal liability arising from market price fluctuations. The use of target date funds has grown significantly over the following decade.) The key aspect of this tier is that target date funds provide a single investment fund, differentiated by expected retirement date, that is diversified, rebalanced systematically and will reduce its equity exposure and riskiness as the participant nears retirement.

The second and third tiers are designed for ‘fine tuners.’ The second tier consists of 3-5 low-cost investment options that are broadly diversified and serve as building block portfolios that cover the major asset classes (cash, bonds, and stocks). The investment options are typically passive, but not exclusively (passive management is not available in the stable principal category (money market or stable value funds)). Fund options in the third tier cover the same asset classes offered in tier two but with additional specialization. This can be seen through the availability of style-based funds (e.g., value and growth, large and small capitalization). These funds are predominately actively managed. If a plan sponsor offers socially responsible funds, they will reside in tier three.

The fourth tier of the investment menu is the self-directed brokerage account or mutual fund window. This option is offered by some but not all plan sponsors. ‘Customizer’ participants desire investment flexibility not present in the first three tiers will find a full set of individual securities, mutual funds, and ETFs available through this tier. Providers typically charge additional fees for this service in the form of annual account maintenance and transactional fees.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice. Any views expressed herein are those of the author(s) and not necessarily those of Multnomah Group or Multnomah Group’s clients.