Over the last couple of months, there have been many articles written about market volatility and the need for sticking to a long-term investment strategy for retirement plan accounts. Volatility is unsettling, particularly if the volatility is to the downside. I decided to look at how active managers have performed during this period of increased downside volatility. Active management has struggled during the past few years of strong equity markets. For many of the proponents of active management, they believe that active managers can best add value when markets are volatility and equities are struggling.

As a quick refresher, actively managed funds seek to outperform their designated benchmark by building a portfolio of securities that is different than the benchmark. In general, many of the securities held in an active fund will also be held in the index but in different percentage weights. Thus, a manager can overweight securities they believe will outperform and underweight those they believe will underperform.

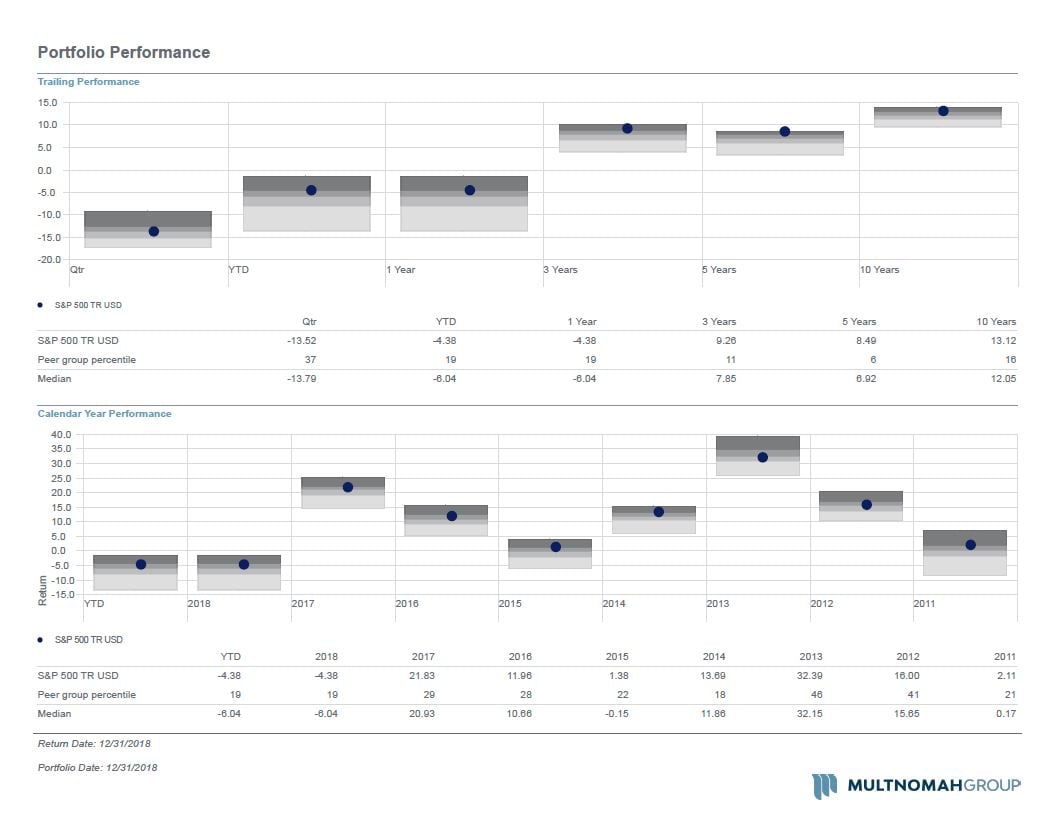

The S&P 500 Index is a proxy for the U.S. equity market and is commonly an index fund offering in retirement plans. The two charts below show performance of the index versus other large cap U.S. equity funds in Morningstar’s U.S. Large Blend peer group. The first chart shows performance for periods ending Dec. 31, 2018 and the second shows performance for the last eight calendar years.

(to view a larger image, please click here)

The S&P 500 Index outperformed the large cap blend peer group median in each of the last eight calendar years and ranks in the top quartile of the peer group for the last five- and 10-year periods.

Before we jump to the conclusion that active management is dead, let’s broaden our view. The table below provides information on the performance of the index versus their representative style peer group of commonly offered asset classes in retirement plans.

|

|

|

Benchmark Rank in Peer Group (periods ending December 31, 2018) |

|

||

|

Peer Group |

Benchmark |

4th Quarter |

Five Years |

Ten Years |

Number of Observations Above Median in last Eight Calendar Years |

|

Large Cap Value |

Russell 1000 Value |

34 |

32 |

38 |

6 |

|

Large Cap Blend |

S&P 500 |

37 |

6 |

16 |

8 |

|

Large Cap Growth |

Russell 1000 Growth |

54 |

13 |

18 |

6 |

|

Small Cap Value |

Russell 2000 Value |

36 |

25 |

63 |

3 |

|

Small Cap Growth |

Russell 2000 Growth |

68 |

53 |

50 |

5 |

|

International Value |

MSCI ACWI ex-USA Value |

8 |

36 |

25 |

3 |

|

International Growth |

MSCI ACWI ex-USA Growth |

22 |

39 |

58 |

4 |

|

International Small Cap |

MSCI World Ex USA SMID |

23 |

28 |

77 |

4 |

Observations:

- Over the last 10 years, actively-managed equity funds have generally underperformed their index. Exceptions noted in small cap value, international growth and international small cap. The index matched the median performance of the small cap growth peer group.

- Active managers protected more in the down market (4th quarter 2018) in the two U.S. growth styles. Growth stocks have outperformed their value counterparts by a significant margin over the last 10 years, particularly in large cap. Otherwise, active managers appeared to generally underperform their index last quarter.

I view this data as strengthening the argument that low-cost passive funds are appropriate options for retirement plan participants. The belief that active management will generally outperform in volatile or losing markets appears unfounded. On average, most active managers continue to underperform their benchmarks regardless of market environment. We view the use of active managers to be appropriate, but investors should understand that finding active managers that can add value net of fees is difficult because they are the minority of options in the market. Keeping fund management fees low improves the probability that active managers add value.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice. Any views expressed herein are those of the author(s) and not necessarily those of Multnomah Group or Multnomah Group’s clients.