Within the international equity peer groups there is a breakdown by size (Large or Small/Mid) and style (Value, Blend, or Growth). These peer groups include funds that invest primarily in the stocks of companies located in non-US developed countries. As a result, we use variants of the MSCI World ex US Index, which has no emerging markets exposure, to benchmark the funds within these peer groups. While the funds in these peer groups invest primarily in non-US developed market stocks, each fund can have a different policy regarding their investment in emerging market stocks. Some funds invest solely in developed markets while others may invest upwards of 30% in emerging markets. Those differences can have a significant impact on the relative performance of a fund.

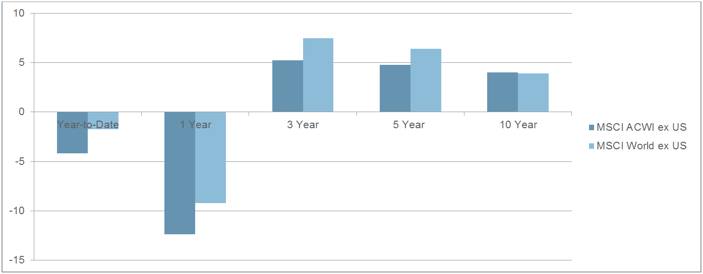

Emerging markets have been hit hard over the last year by falling commodities prices, political scandals in Brazil, and concerns about slowing growth and government market intervention in China, making a fund’s exposure to emerging economies the most significant short-term differentiator of returns within the international fund categories. The impact of the poor emerging market environment is apparent in the analysis of two international benchmarks: the MSCI World ex US Index and an alternate MSCI index, the All Country World Index (ACWI) ex US. MSCI ACWI ex US currently includes an allocation of roughly 15% to emerging markets, and for the year ended August 31st has underperformed the MSCI World ex US Index by 310 basis points (see the following chart). Funds that invest in emerging markets have tended to lag their peers that maintain lower, or non-existent, emerging market allocations. Conversely, in prior periods when emerging markets outperformed developed markets, these funds appeared to outperform their peers.

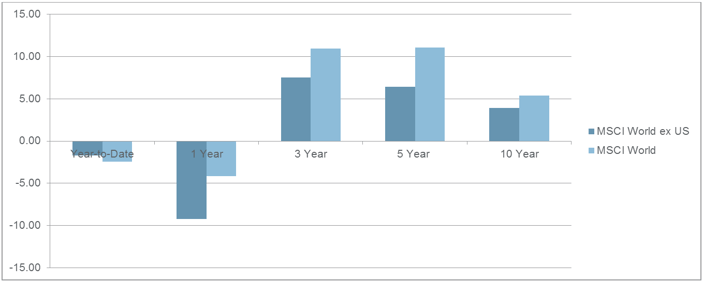

Similar to the developed/emerging market story, US/non-US exposure can have a material impact on recent performance comparisons. While most funds with significant exposure to both US and international markets fall into the World Stock category, some international funds are allowed to invest in the US stock market. This time using the MSCI World ex US index, which has a 0.27% weighting to US stocks, and the MSCI World Index with a 57% allocation to the US, illustrates the performance gap with an over 500 basis point differential favoring the higher US allocation over the 1-year period ended August 31st.

These differences aren’t just hypothetical as we have seen them as an issue in evaluating the recent relative performance of a number of funds in our clients’ investment menus. There are a couple of key takeaways from this comparison. First, peer groups can be useful, but frequently they are broad enough to support fundamentally different investment strategies. These differences can frequently generate variability in relative performance that should not be attributed to a manager’s skill, or lack thereof. Second, understand the benchmarks that you use. When used properly, benchmarks can be extremely helpful in understanding the value of a manager. When not understood, benchmark-relative analysis can be abused to make poorly timed decisions with negative performance consequences. Lastly, understand your managers. Don’t buy a manager just because they were in top decile of their peer group or because they outperformed their benchmark. Know their investment philosophy, how it compares to and differs from its peers, and what their portfolios look like. Taking these steps will help you avoid hiring and firing managers for the wrong reasons.