I know it’s a trope, but one that annually I voluntarily participate in - creating resolutions to ring in the New Year. The list I came up with for myself is probably a pretty familiar list:

- Get Healthy

- Get Organized

- Spend Less

- Save More

- Learn Something New

Reflecting on my list, I’m struck by how similar these resolutions are to the work we do for so many of our clients each year. While the resolutions above are mine, you might consider them for your retirement plans as well.

Get Healthy

The retirement plan we sponsor, and the plans we consult on for our clients, are constantly changing as new participants enter and leave, investment products and markets change, and rates of saving fluctuate. The health of any retirement plan comes down to how effective it is in aiding participants in preparing for an adequate retirement. We are encouraging our clients to continue to evaluate and then improve the health of their retirement plans.

Get Organized

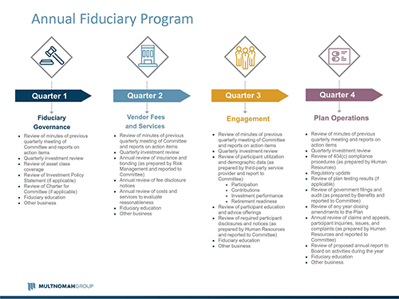

Maintaining a retirement plan can be a thankless job. Dozens of responsibilities each year with consequences for failing to meet the obligations. Nearly all plan sponsors have limitations on the amount of time they can spend addressing the changing requirements of managing a retirement plan effectively. Every sponsor should have an organized process for addressing their obligations each year. Our Annual Fiduciary Program (see image below, click the image for a full PDF) is what we use with our clients. Whatever your method to ensure you are on top of your obligations as a plan sponsor, staying organized is critical.

Spend Less

Every week we meet with retirement plan providers, and nearly all of them have commented on the rate of fee compression in the marketplace. One of the more impactful ways to improve plan health is to minimize the impact of fees on participants. If you haven’t conducted a thorough fee benchmarking exercise in the past two years, now is the time. You’ll be surprised by what you find.

Save More

Improving participant savings rates is the most impactful step any sponsor can make towards plan health. Investment menu improvements and fee reductions are effective at the margins, but revolutionary changes can be achieved by increasing the amount the population saves toward retirement. Behavioral finance and auto saving features continue to demonstrate their ability to positively impact savings rates and improve plan health. Your next new hire will thank you… eventually.

Learn Something New

We recently worked on trying to plot out the information that you may need to be an effective sponsor and fiduciary to your plan, and the list was longer than we expected. For nearly all of our clients, issues related to the retirement plan are only a portion (frequently a small one) of their total job responsibilities. It is impossible to become a retirement plan expert overnight (I’m two decades in and still learn something new nearly every day), but commit to picking a piece of your plan and understanding it. Over time you can increase your knowledge base and effectiveness dramatically.

We’ll help. On Jan. 24, 2018 we’re hosting a webinar where we discuss five potential retirement plan resolutions in the new year. I hope you can join us.

We founded the firm more than fourteen years ago to help make plan sponsors more effective in helping their employees secure retirement with dignity. We appreciate you subscribing to the blog and the work you do on behalf of retirement plans.

Happy New Year.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice.

Any views expressed herein are those of the author(s) and not necessarily those of Multnomah Group or Multnomah Group’s clients.