In this, our second in the series on factor investing (you can find the first blog here), we dissect the return premium inherent in small cap stocks.

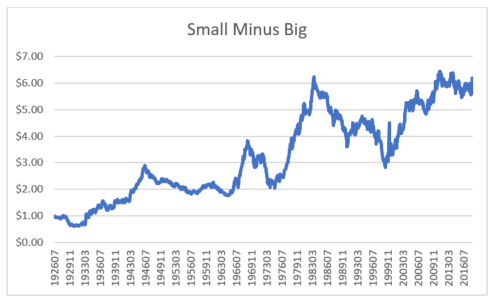

The hypothesis that small cap stocks provide excess return premium is hotly debated. Below is a chart showing the growth of a dollar invested in a strategy that is long small cap stocks and short large cap stocks. This data is courtesy of Professor Kenneth French’s website. Prof. French is the co-founder of the Fama-French Three Factor Model.

As the above graph shows, being long small cap stocks while being short large cap stocks has provided a tremendous amount of capital growth over the time period (1926 to present). Clearly, the picture shows that the equity of smaller companies outperforms large, right? Some critics point to the period of the mid-80’s to the present during which small caps have not outperformed large caps, exclaiming that the premium is dead. Others further argue the small cap effect is so sporadic, leaving the efficacy of this hypothesis in limbo. However, recent work conducted by AQR (an investment management firm based in Connecticut) shows that the small cap premium is quite strong and robust when controlled for certain factors… well, mainly quality[1]. AQR believes companies that exhibit “profitability, profit growth, low risk in terms of return-based measures and stability of earnings, and high payout and/or conservative investment policy” tend to outperform “junky” companies that do not exhibit the aforementioned characteristics. In other words, investing in small cap stocks may not provide a return premium; however, investing in small cap stocks that exhibit strong quality profile does indeed provide a return premium.

Here at Multnomah Group, we tend to favor utilizing small cap funds within the active or extended array. We believe that small cap investing does provide an excess return; however, we believe that small cap investing is best in the hands of active managers. Our selection of active managers broadly and specifically within the small cap space tend to lean heavily towards funds which exhibit a strong focus on buying good businesses. Regardless of value or growth tilt, our recommended managers rely on fundamental analysis to discern good businesses from bad, often focusing on the very qualities of profitability, profit growth, and strong management.

Notes:

[1] “Size Matters, if You Control Your Junk”, Asness, Frazzini, Israel, Moskowitz, Pedersen, 2015

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice.

Any views expressed herein are those of the author(s) and not necessarily those of Multnomah Group or Multnomah Group’s clients.