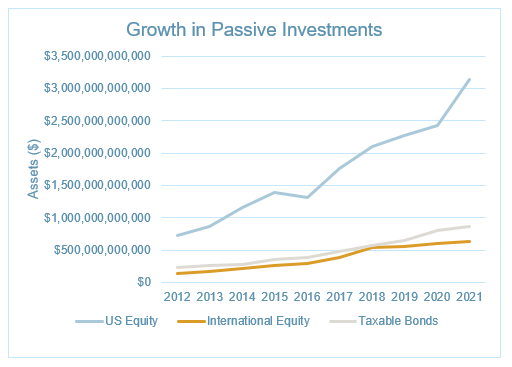

The past decade has seen explosive growth in passive, index investments. This growth has been for good reasons; these funds provide broad diversification, low costs, and have generally outperformed the average active investment products within their peer group or asset class.

The past decade has seen explosive growth in passive, index investments. This growth has been for good reasons; these funds provide broad diversification, low costs, and have generally outperformed the average active investment products within their peer group or asset class.

For employer-sponsored retirement plans, almost every plan available has one or more index funds within their investment menu. But in our experience, investment committees frequently overlook index funds in their fund review because of their plain-vanilla approach to investing and their consistent relative performance (they don’t tend to outperform or underperform significantly).

While most people think of Vanguard for index products, there are many providers that manage index strategies now. For some of these managers, their index fund strategies are primarily defensive positions to capture assets that were otherwise likely to leave their fund family for another provider. Some recordkeepers have used proprietary options to generate additional revenue from their clients who may otherwise use an open-architecture investment menu for the actively managed funds.

In many ways, index investing is a scale business, and the largest providers have been able to drive the cost of index fund management lower. If you use proprietary index funds from your recordkeeper, you should look at their costs to see if they are competitive with the market leaders. Only a few years ago, the Vanguard 500 Index cost 0.18% annually, so another provider with an S&P 500 Index fund costing 0.18%-0.25% might look competitive to Vanguard’s offering. Now that same fund costs 0.04%, and Fidelity alternative costs 0.015%. If the competitor hasn’t kept pace with their price reductions, the difference in cost can be quite extreme.

Beyond looking at cost, you should also understand that not all index funds are the same. Each index fund tracks a specific index, and funds that may be categorized or named similarly may not track the same index. As an example, there are a variety of international equity indices. Some invest in only developed countries, some also invest in emerging markets, and they may vary in market cap size. These contrasts can lead to different expenses as emerging markets are generally more expensive to manage and may also lead to different asset class exposures than expected. You should understand the underlying index that your funds are designed to track. Then, when you compare that fund against other options, you should determine whether they are an apples-to-apples comparison. If not, understand how the differences can impact the comparison.

Beyond understanding fees and the underlying benchmark, plan fiduciaries should understand that not all index funds are created equal. As indexing has expanded beyond tracking the S&P 500 Index, it has become more complex and required greater skill. Most people believe that index funds fully replicate the index. What this means is that if the index contains 500 stocks, the index fund manager buys all 500 stocks in the exact weights they represent of the index. This type of index fund management is common in highly liquid asset classes, but in some cases, it may not be possible.

For example, bond indices contain thousands of individual securities and there is not a centralized public market where all of those securities are traded. Because of the difficulty in trying to fully replicate the index, index managers may use sampling techniques to track the index. In this case, they buy a subset of the securities in the index and try to make sure that their portfolio matches the index's overall exposure. In the bond fund example, this may mean that they try to match the sector exposure, duration, yield, and credit quality of the index, while only owning a subset of the securities in the index. Another option is to use derivatives to provide index exposure and manage the underlying collateral. Fully replicating less liquid asset classes or using sampling techniques requires skill on the part of the manager. If done poorly, the index fund may not track the index as you expect.

Combining the growth of money invested in passive, index funds and the potential complexity to accurately implement index fund strategies, plan fiduciaries should add regular reviews of their index funds to their fiduciary agenda.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice. Any views expressed herein are those of the author(s) and not necessarily those of Multnomah Group or Multnomah Group’s clients.