Over the course of the next several blogs posts, our investment research team will be discussing our investment manager selection process for actively-managed funds. We walk through how we construct actively-managed investment menus and evaluate investment management teams, philosophy and process, and portfolio construction and risk controls.

Our retirement plan investment menu design is built on three guiding principles:

- Balance simplicity and participant choice

- Costs matter

- Tiered investment menu

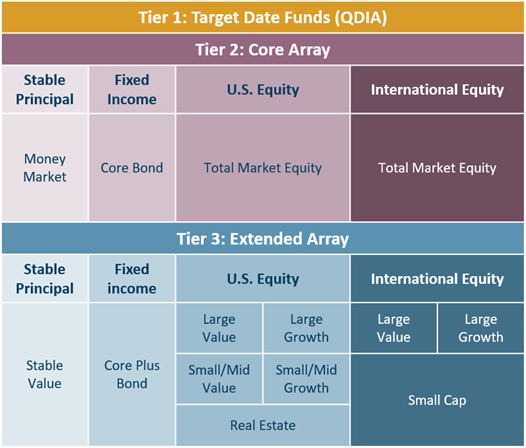

We’ll begin with our philosophy of investment menu design, which incorporates investment “tiers.” The tiered approach is easy to communicate to participants and can assist them in building the right portfolio for their degree of investment knowledge. The first tier of the investment menu is typically a suite of target date funds (in many cases the plan’s qualified default investment alternative “QDIA”). This tier is designed for participants who want to invest for retirement but prefer to leave the asset allocation decisions to professional investment managers.

The second tier provides a small selection of broad asset class investment products, including a stable principal investment option, fixed income, U.S. and international equities. Frequently, the investment products within this tier are broad-based index funds because they give participants the basic building blocks for a diversified portfolio at a low investment expense.

The third tier is an extended set of options that provide participants choices among narrower asset class and investment style categories. Usually, this tier is populated with a selection of actively-managed and style-pure mutual funds. It is the focus of this resource.[i]

The primary objective of investment menu design is to provide participants with the building blocks for a properly diversified portfolio. At the same time, we need to ensure that participants don’t become overwhelmed by the number of choices available and make adverse decisions (or no decisions). To balance these needs, we believe that the best design for the extended fund tier (tier 3) provides options that are differentiated by asset class, market capitalization, and investment style.

Some employers may prefer to expand the menu a bit further to include asset classes such as inflation-linked bonds or emerging markets equity, but the principles here remain the same: the investment options should be distinct and differentiated.

An optimal retirement plan menu utilizes “style-pure” options – funds that are dedicated to either value or growth investing – to avoid high correlations between managers that could impair participants’ ability to build a diverse portfolio.

And while historical returns are not an indicator of future results, we look for managers who have demonstrated a commitment to their investment philosophy and process as this is the best means available to ensure that returns are repeatable and not an outcome of pure chance.

Our next blog in this series will focus on what we look for within an investment team's structure. If you're interested in reading our guide focused on this topic written by our senior investment analyst, Tina Beltrone, and our investment analyst, Caryn Sanchez, please click here.

Notes:

[i] For the purpose of this resource, we will exclude asset allocation funds – including target date funds and index funds due to their differing considerations in due diligence and menu construction needs. For more information on target date fund selection, please see our webinar on the topic.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice.