Once upon a time, asset custodians and recordkeepers were selected based on the quality of the investment products they managed and made available to consumers. For retirement plans, that dynamic has been gradually changing for years. Even to the point where virtually any retirement plan of any size should be selecting retirement plan custodians and recordkeepers based on their ability to meet the needs of participants and with full knowledge that the plan can use the best investment options in the marketplace in nearly any custodial environment.

Back on June 19, I published a piece outlining the five areas recordkeeping vendors have tried to monetize their relationship with retirement plan sponsors and participants:

- Proprietary investment management

- Managed accounts

- IRA rollovers

- Cross-selling retail financial products

- Annuitization

In this piece, the first in a five-part series where we discuss each of these provider revenue opportunities, I’ll highlight proprietary investment management.

Unlike providing recordkeeping services to retirement plan sponsors, investment management is a highly profitable and scalable revenue opportunity. While financial service firms may receive asset based or per capita fees scaled by the complexity of the work they provide, investment managers collect asset based fees that grow along with the performance of the market. As recordkeeping firms grow, they are pressed for significant investments in technology and to add staff to service plan sponsors and participants alike.

Investment managers have virtually no marginal costs as their investment mandates grow. Funds become more “profitable” as the fixed legal, accounting, and research costs are spread across a larger and larger asset base.

Annually, Multnomah Group benchmarks fees for recordkeeping services to our clients and details investment management costs at the same time. For larger plan sponsors, investment management costs may be as much as four-times the cost of recordkeeping services. Given the scale of revenue available in investment management and the profitability of that revenue, it should be no surprise the degree to which recordkeepers may have interest in seeing their investment products in the investment menus of their retirement plan clients.

In addition to using captive recordkeeping clients to promote the marquee investment products from the recordkeeper, financial service firms regularly steer plan sponsors to use proprietary investments in three core areas:

- Cash alternatives – Whether it’s insurance companies selling annuity and stable value accounts, or mutual fund companies with money market funds, these mandates which are largely commoditized are promoted heavily by retirement plan providers

- Indexes – Index funds continue to take significant cash flows in retirement plans. As mutual fund companies compete for the lowest-cost index, retirement plan providers are encouraging sponsors to use proprietary indexes in their menus

- Target dates – Whether active or passive, retirement plan providers are using their trusted role with committees to communicate the merits of their proprietary target date investment products

The success of those initiatives is clear. According to a study conducted jointly by AllianceBernstein and BrightScope in 2017[1], 43% of sponsors were using proprietary target date funds in their plan. While this is down from 59% back in 2009, it’s clear that the link between retirement plan providers and target date funds utilized remains strong. According to the same study, 31.7% of billion-dollar and greater plans used proprietary target date funds.

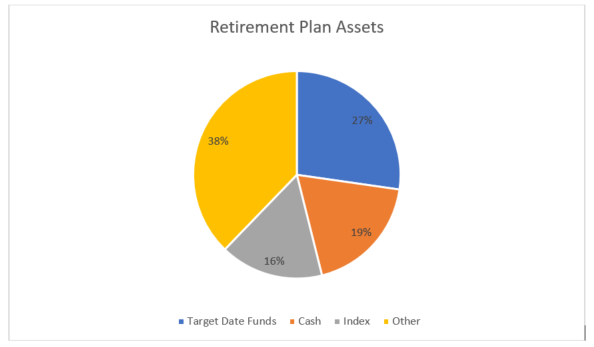

Even if the correlation between proprietary investment mandates and recordkeepers is mild the opportunity is huge. As of June 30, 2018, 62% or our clients’ retirement plan assets were in target date funds, cash, or index products.

The Department of Labor has been aware of these correlations for some time. In 2013, the DOL published tips for plan fiduciaries that included the tip, “Inquire about whether a custom or non-proprietary target date fund would be a better fit for your plan.”

Many plan recordkeepers have excellent investment products, and sponsors should use those products when they meet the needs of the plan, its participants, and adhere to your investment policy statement. However, any plan using proprietary funds should be cognizant of their requirements to evaluate those products with the same care and rigor they would any other investment product. Using proprietary funds may make sense, but fiduciaries should take extraordinary care in ensuring the independence of the plan provider and investment product decisions.

Notes:

[1] https://www.alliancebernstein.com/sites/investments/us/resources/pdf/final_dci-7572-0717.pdf

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice.

Any views expressed herein are those of the author(s) and not necessarily those of Multnomah Group or Multnomah Group’s clients.