For their many faults, retirement plans have become one of the most useful tools for generating middle-class wealth.

The service providers that manage these plans on behalf of their plan sponsor clients have seen the tremendous growth of this market first hand.

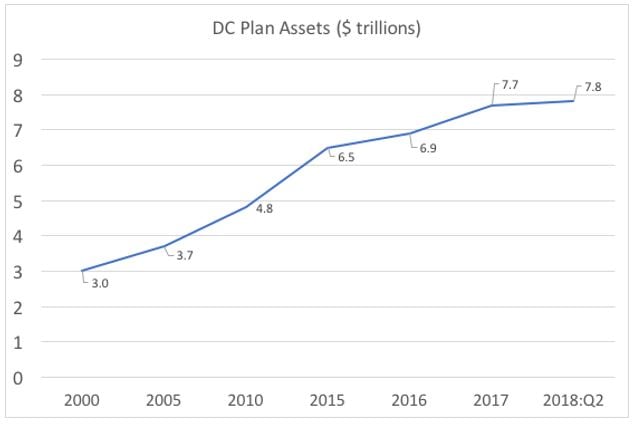

ICI Retirement Plan Asset Statistics, published Sept. 27, 2018 (https://www.ici.org/research/stats/retirement/ret_18_q2)

For many, the accumulation portion of retirement savings in defined contribution plans is simple enough - save as much as you can for as long as you can. Automatic enrollment, auto escalation, and default investment alternatives that manage asset allocation during the accumulation phase have effectively created a generation of retirement plan savers who could accumulate an adequate retirement while having a very limited knowledge of investing or retirement plans.

The provider marketplace has been an active player in the transition of assets from institutional retirement plan assets to retail IRA accounts. However, some of the automatic plan features that have driven growth in retirement assets have also impacted participant engagement. Participants who weren’t required to engage in their asset accumulation strategy may also be less inclined to actively engage in IRA rollovers and the issue of decumulation. Annuitization becomes a potential option to enhance recordkeeper income by assisting participants with managing decumulation.

By way of refresher, annuitization occurs when a participant elects to take a pool of assets today to purchase the promise of income over their lifetime (and perhaps beyond). Annuitization should eliminate longevity risk - the risk of a participant outliving their retirement savings, by transferring that risk to an insurance company. In an annuitization setting, participants pool their mortality risk. While you or I may not know when we will die, an insurance company with a large enough pool of participants should be able to predict with some accuracy the average life expectancy of the pool. Insurance companies invest in their general account with the objective of making the promised monthly annuity payments to purchasers.

While annuities have a bad reputation, the type of income annuities a participant may elect to purchase in retirement may very well enhance their retirement security when purchased by a mindful participant with concerns about outliving their income.

Currently, participants electing annuitization is rare. According to a 2017 LIMRA annuity sales survey, in 2017 immediate income annuity sales were only $8.3 billion, but in a $7.8 trillion defined contribution marketplace the potential for growth is great.

While not as lucrative as some insurance products, income annuities are an attractive income source for many insurance companies. When a participant purchases a lifetime annuity, the assets of the participant are invested in the general account of the insurance company. The life insurance companies earn income by investing those proceeds and achieving a rate of return higher than that required to pay their income obligations by participants.

Unlike property or disability insurance solutions where natural catastrophes or economic slowdowns can lead to unpredictable claim activity, lifetime income annuities rely on highly predictable mortality behavior for large pools making profits predictable and consistent for insurers.

Interest among financial service companies in lifetime income has never been higher. Earlier this year, a group of financial services companies created the Alliance for Lifetime Income to educate Americans about the value of protecting income, simplifying retirement income planning, and helping consumers better understand annuities.

While retirement income may be appropriate for many participants, it is also unquestionably a product sale opportunity to some recordkeeping service providers. Plan sponsors will need to continually monitor their retirement service provider to ensure the solutions presented to their participants are monitored and are not biased by the profit motives of their providers.

Multnomah Group is a registered investment adviser, registered with the Securities and Exchange Commission. Any information contained herein or on Multnomah Group’s website is provided for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Multnomah Group does not provide legal or tax advice. Any views expressed herein are those of the author(s) and not necessarily those of Multnomah Group or Multnomah Group’s clients.