Rebalancing is the practice of getting your portfolio asset allocation back to strategic targets. This is largely done for the sake of risk management, rather than enhancing returns. The return side of the equation gets the headlines, while the risk side only gets mentioned in the most severe of events. However, we need to be as mindful of the risk side of the equation.

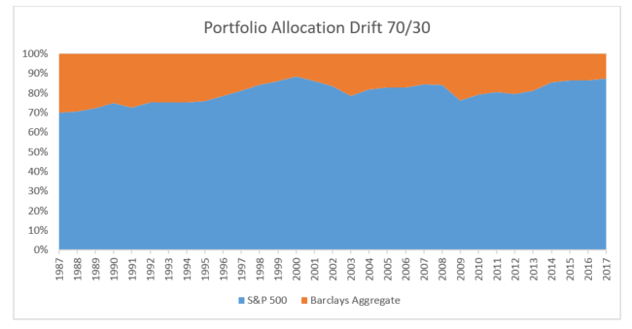

Below are a few graphs that highlight how your portfolio allocations would have changed through time if you did not rebalance your portfolio. These three graphs are from the period January 1987 to April 2017. Each graph represents different allocation percentages, starting from 70% equities and 30% bonds to 30% equities and 70% bonds.

As you can see in the graph above, the initial asset allocation of 70% equities and 30% bonds has over time drifted towards 80% equities and 20% bonds.

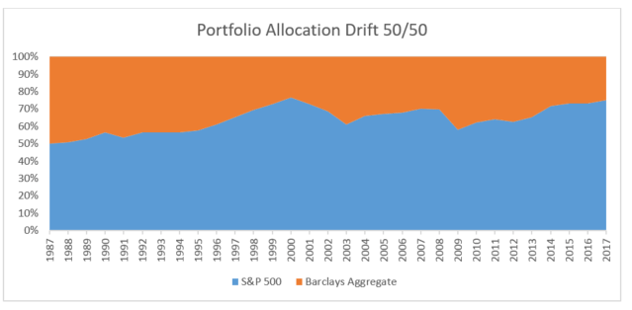

Below are two more graphs.

The portfolio above started at 50% equities and 50% bonds. It then drifted to a 70% equities and 30% bonds due to not rebalancing the portfolio.

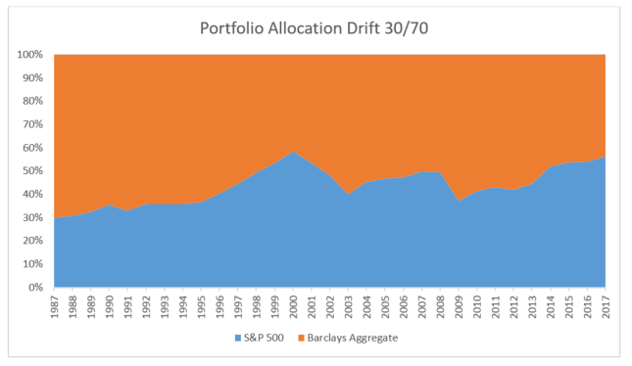

The portfolio above is now at 50% equities and 50% bonds, after having started at 30% equities and 70% bonds.

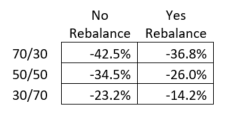

Not rebalancing the portfolio has, in every case above, generated a higher rate of return. However, this comes with a potentially dangerous side effect. Below is a table showing the maximum amount of loss from not rebalancing versus rebalancing during the period of 1987 to 2017:

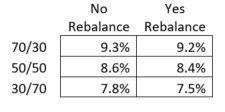

As you can tell, rebalancing your portfolio dramatically reduces the magnitude of loss during the inevitable market hiccups. How much do you give up in annualized return for this risk management tool? Here is the table showing the returns difference between rebalancing and not rebalancing:

The differences in annualized returns is marginal, whereas the differences in losses is quite substantial.

Rebalancing is largely a risk management tool. Although analyzing risk does not get as much attention as the returns generated by the markets, it remains just as important in managing your portfolio. If you have not been rebalancing your portfolio, then the high rates of return for the U.S. stock market since the depths of the Great Financial Crisis in 2008 have undoubtedly led to imbalances in your asset allocation.

Today might be a good time to think about getting your asset allocation back to target weights. The exact same holds true, although flipped, when the equity markets have fallen dramatically. In this scenario, your portfolio is likely underweight equities relative to target. Therefore, you should be buying more equities during the inevitable market declines.